Question: Please show how A B D E LL 1 2 The following table contains information on stocks in an equity fund. 3 4 The Garrett

Please show how

Please show how

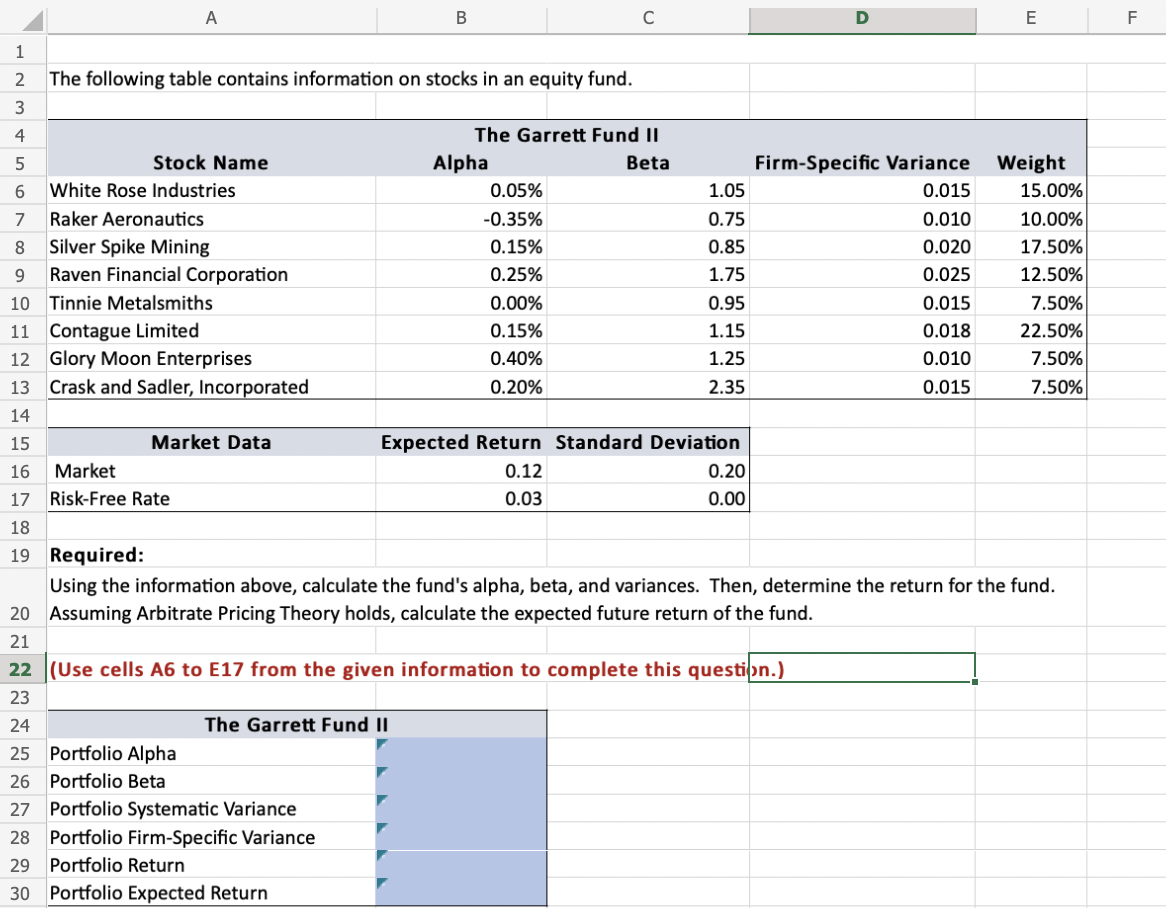

A B D E LL 1 2 The following table contains information on stocks in an equity fund. 3 4 The Garrett Fund II 5 Stock Name Alpha Beta Firm-Specific Variance Weight 6 White Rose Industries 0.05% 1.05 0.015 15.00% 7 Raker Aeronautics -0.35% 0.75 0.010 10.00% 8 Silver Spike Mining 0.15% 0.85 0.020 17.50% 9 Raven Financial Corporation 0.25% 1.75 0.025 12.50% 10 Tinnie Metalsmiths 0.00% 0.95 0.015 7.50% 11 Contague Limited 0.15% 1.15 0.018 22.50% 12 Glory Moon Enterprises 0.40% 1.25 0.010 7.50% 13 Crask and Sadler, Incorporated 0.20% 2.35 0.015 7.50% 14 15 Market Data Expected Return Standard Deviation 16 Market 0.12 0.20 17 Risk-Free Rate 0.03 0.00 18 19 Required: Using the information above, calculate the fund's alpha, beta, and variances. Then, determine the return for the fund. 20 Assuming Arbitrate Pricing Theory holds, calculate the expected future return of the fund. 21 22 (Use cells A6 to E17 from the given information to complete this questipn.) 23 24 The Garrett Fund II 25 Portfolio Alpha 26 Portfolio Beta 27 Portfolio Systematic Variance 28 Portfolio Firm-Specific Variance 29 Portfolio Return 30 Portfolio Expected Return A B D E LL 1 2 The following table contains information on stocks in an equity fund. 3 4 The Garrett Fund II 5 Stock Name Alpha Beta Firm-Specific Variance Weight 6 White Rose Industries 0.05% 1.05 0.015 15.00% 7 Raker Aeronautics -0.35% 0.75 0.010 10.00% 8 Silver Spike Mining 0.15% 0.85 0.020 17.50% 9 Raven Financial Corporation 0.25% 1.75 0.025 12.50% 10 Tinnie Metalsmiths 0.00% 0.95 0.015 7.50% 11 Contague Limited 0.15% 1.15 0.018 22.50% 12 Glory Moon Enterprises 0.40% 1.25 0.010 7.50% 13 Crask and Sadler, Incorporated 0.20% 2.35 0.015 7.50% 14 15 Market Data Expected Return Standard Deviation 16 Market 0.12 0.20 17 Risk-Free Rate 0.03 0.00 18 19 Required: Using the information above, calculate the fund's alpha, beta, and variances. Then, determine the return for the fund. 20 Assuming Arbitrate Pricing Theory holds, calculate the expected future return of the fund. 21 22 (Use cells A6 to E17 from the given information to complete this questipn.) 23 24 The Garrett Fund II 25 Portfolio Alpha 26 Portfolio Beta 27 Portfolio Systematic Variance 28 Portfolio Firm-Specific Variance 29 Portfolio Return 30 Portfolio Expected Return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts