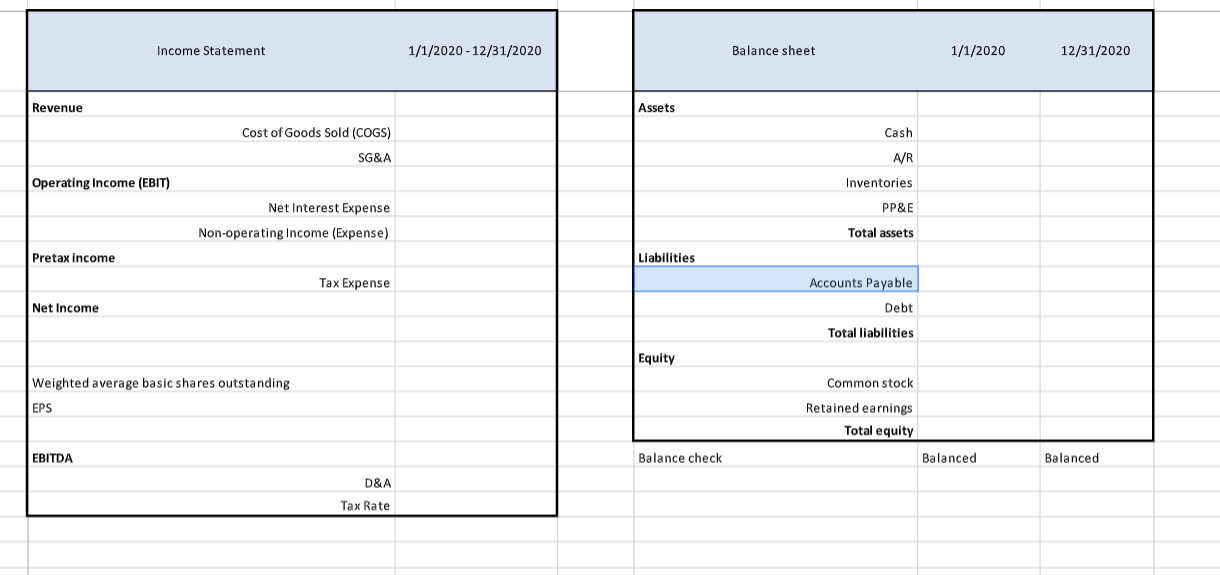

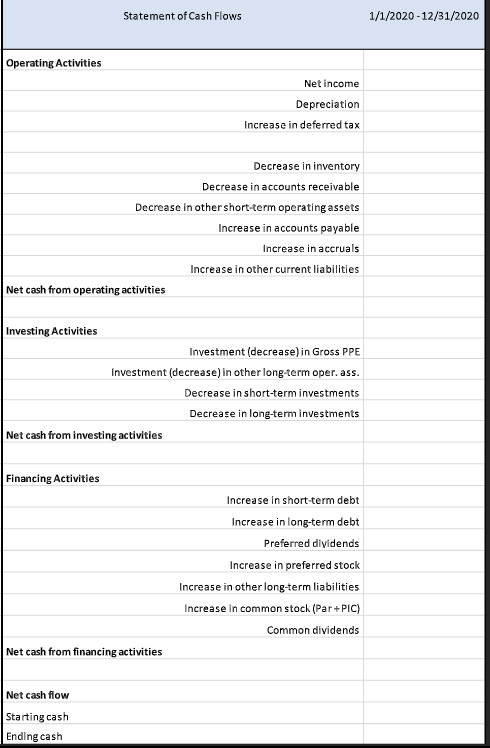

Question: Please show how these actions affect the statement sheets below. Please enter answers in format provided below. 7 March 1, 2020 In order to operate

Please show how these actions affect the statement sheets below. Please enter answers in format provided below.

| 7 | March 1, 2020 | In order to operate your mold business, you will need to have an inventory of special chemicals to treat and prevent mold. You estimate that for each completed project, $800 worth of chemical is used. However, because you have to buy the chemical in bulk from your supplier, you buy a starting inventory of $70,000 on credit. |

| 8 | April 1, 2020 | During a project, one of your specialists accidentally sprayed a client's cat, Mr. Fluffykins, with the mold chemical. Mr. Fluffykins developed a horrible rash and started foaming at the mouth, and because Mr. Fluffykins is an extremely valuable part of the family, the client paid $1,500 in veterinary services. The client sued you and because you did not have liability insurance, you hired a lawyer and ended up settling with the client for $5,000. |

| 9 | June 30, 2020 | To help support your business growth, you hire a Salesperson for $12,000 per year paid (monthly payments starting now) + 15% of the value of completed projects that are sold. |

| 10 | June 30, 2020 | On June 30, 2020, you find an investor who invests $200,000 and you issue them 1000 shares. |

| 11 | December 15, 2020 | With your future in mind, you purchase a warehouse building to serve as an office/equipment storage facility for $100,000. |

| 12 | December 20, 2020 | You pay your chemical supplier back 50% of what the credit they extended to you. |

Income Statement 1/1/2020 - 12/31/2020 Balance sheet 1/1/2020 12/31/2020 Revenue Assets Cost of Goods Sold (COGS) Cash SG&A A/R Operating Income (EBIT) Inventories PP&E Net Interest Expense Non-operating Income (Expense) Total assets Pretax income Liabilities Tax Expense Accounts Payable Net Income Debt Total liabilities Equity Weighted average basic shares outstanding EPS Common stock Retained earnings Total equity EBITDA Balance check Balanced Balanced D&A Tax Rate Statement of Cash Flows 1/1/2020 - 12/31/2020 Operating Activities Net income Depreciation Increase in deferred tax Decrease in inventory Decrease in accounts receivable Decrease in other short-term operating assets Increase in accounts payable Increase in accruals Increase in other current liabilities Net cash from operating activities Investing Activities Investment (decrease) in Gross PPE Investment (decrease) in other long-term oper.ass. Decrease in short-term investments Decrease in long-term investments Net cash from investing activities Financing Activities Increase in short-term debt Increase in long-term debt Preferred dividends Increase in preferred stock Increase in other long-term liabilities Increase in common stock (Par+PIC) Common dividends Net cash from financing activities Net cash flow Starting cash Ending cash Income Statement 1/1/2020 - 12/31/2020 Balance sheet 1/1/2020 12/31/2020 Revenue Assets Cost of Goods Sold (COGS) Cash SG&A A/R Operating Income (EBIT) Inventories PP&E Net Interest Expense Non-operating Income (Expense) Total assets Pretax income Liabilities Tax Expense Accounts Payable Net Income Debt Total liabilities Equity Weighted average basic shares outstanding EPS Common stock Retained earnings Total equity EBITDA Balance check Balanced Balanced D&A Tax Rate Statement of Cash Flows 1/1/2020 - 12/31/2020 Operating Activities Net income Depreciation Increase in deferred tax Decrease in inventory Decrease in accounts receivable Decrease in other short-term operating assets Increase in accounts payable Increase in accruals Increase in other current liabilities Net cash from operating activities Investing Activities Investment (decrease) in Gross PPE Investment (decrease) in other long-term oper.ass. Decrease in short-term investments Decrease in long-term investments Net cash from investing activities Financing Activities Increase in short-term debt Increase in long-term debt Preferred dividends Increase in preferred stock Increase in other long-term liabilities Increase in common stock (Par+PIC) Common dividends Net cash from financing activities Net cash flow Starting cash Ending cash

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts