Question: Please show how these actions affect the statement sheets below. Please enter answers in format provided below. 1 January 1, 2020 You live in a

Please show how these actions affect the statement sheets below. Please enter answers in format provided below.

| 1 | January 1, 2020 | You live in a very wet and humid area and decide to start a mold remediation company on January 1, 2020. You name your business Volunteer Home Mold Prevention, LLC. To buy all the required equipment and supplies to get started, you estimate that you need $150,000, plus an additional $50,000 for unforeseen expenses/expenditures. |

| 2 | January 1, 2020 | You open a checking account in which you put $75,000 of your own money. You incorporated the issue yourself with 2,000 shares. |

| 3 | January 1, 2020 | You have a friend from your college days that works at the local bank. You go to them and they are able to offer you a 5-year loan of $125,000 at a 5.0% annual interest rate. What a deal! |

| 4 | January 1, 2020 | You buy $50,000 worth of mold prevention equipment with cash. This has a useful life of 10 years. You also buy two work vans with cash for $20,000 each. They both have a useful life of 5 years. All of these are essential to the operation of the business. |

| 5 | January 1, 2020 | You hire an administrative assistant for $40,000 per year to manage the day to day activities and administrative duties of the business. |

| 6 | March 1, 2020 | You recruit a team of professional mold specialists for an total annual salary of $120,000 (Hint: Salary is paid monthly, so be sure to carefully consider whether a full years salary is paid out or a prorated amount). |

| 7 | March 1, 2020 | In order to operate your mold business, you will need to have an inventory of special chemicals to treat and prevent mold. You estimate that for each completed project, $800 worth of chemical is used. However, because you have to buy the chemical in bulk from your supplier, you buy a starting inventory of $70,000 on credit. |

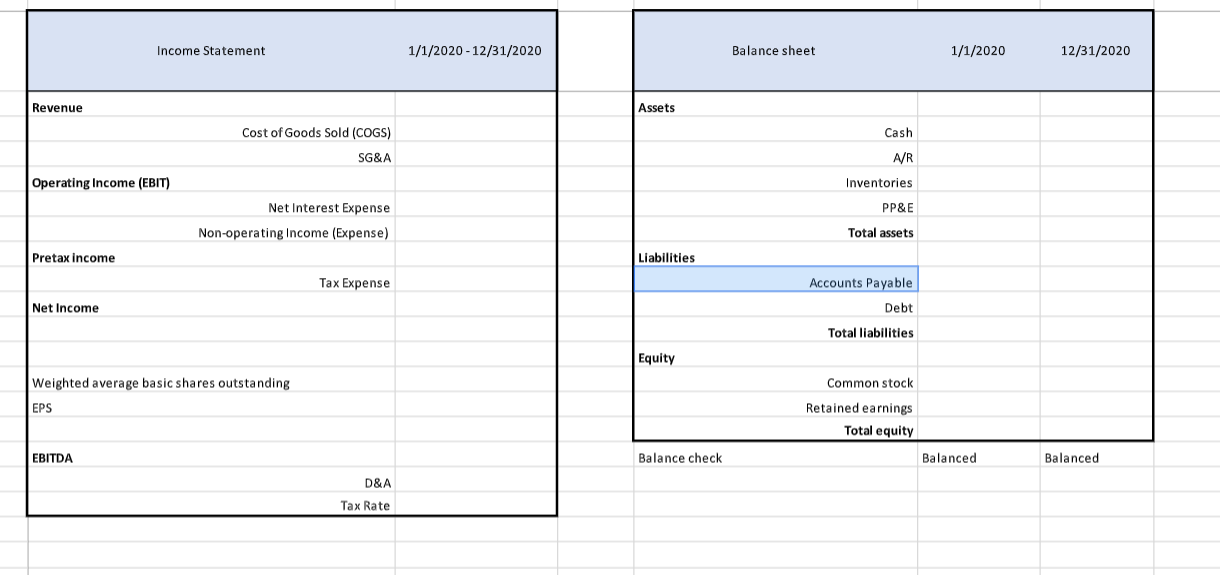

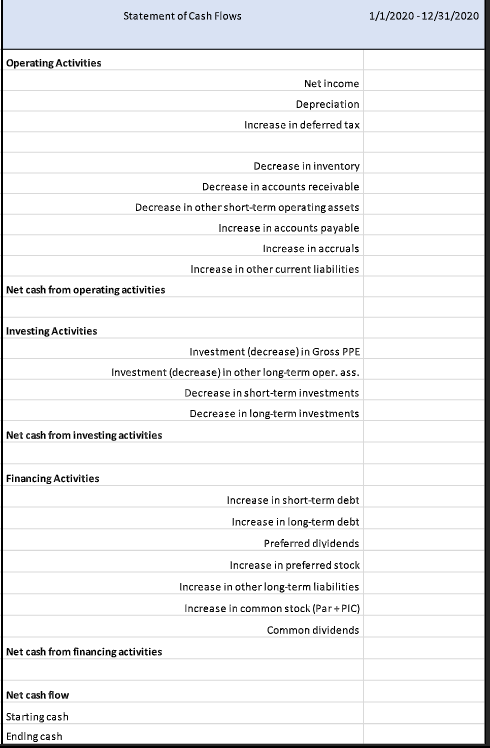

Income Statement 1/1/2020 - 12/31/2020 Balance sheet 1/1/2020 12/31/2020 Revenue Assets Cost of Goods Sold (COGS) Cash SG&A A/R Operating Income (EBIT) Inventories PP&E Net Interest Expense Non-operating Income (Expense) Total assets Pretax income Liabilities Tax Expense Accounts Payable Net Income Debt Total liabilities Equity Weighted average basic shares outstanding EPS Common stock Retained earnings Total equity EBITDA Balance check Balanced Balanced D&A Tax Rate Statement of Cash Flows 1/1/2020 - 12/31/2020 Operating Activities Net income Depreciation Increase in deferred tax Decrease in inventory Decrease in accounts receivable Decrease in other short-term operating assets Increase in accounts payable Increase in accruals Increase in other current liabilities Net cash from operating activities Investing Activities Investment (decrease) in Gross PPE Investment (decrease) in other long-term oper.ass. Decrease in short-term investments Decrease in long-term investments Net cash from investing activities Financing Activities Increase in short-term debt Increase in long-term debt Preferred dividends Increase in preferred stock Increase in other long-term liabilities Increase in common stock (Par+PIC) Common dividends Net cash from financing activities Net cash flow Starting cash Ending cash

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts