Question: PLEASE SHOW HOW TO CORRECTLY WORK THROUGH THE PROBLEM!! WILL THUMBS UP!! THANK YOU!! Problem 14-67 (Static) Compare Historical, Net Book Value to Gross Book

PLEASE SHOW HOW TO CORRECTLY WORK THROUGH THE PROBLEM!! WILL THUMBS UP!! THANK YOU!!

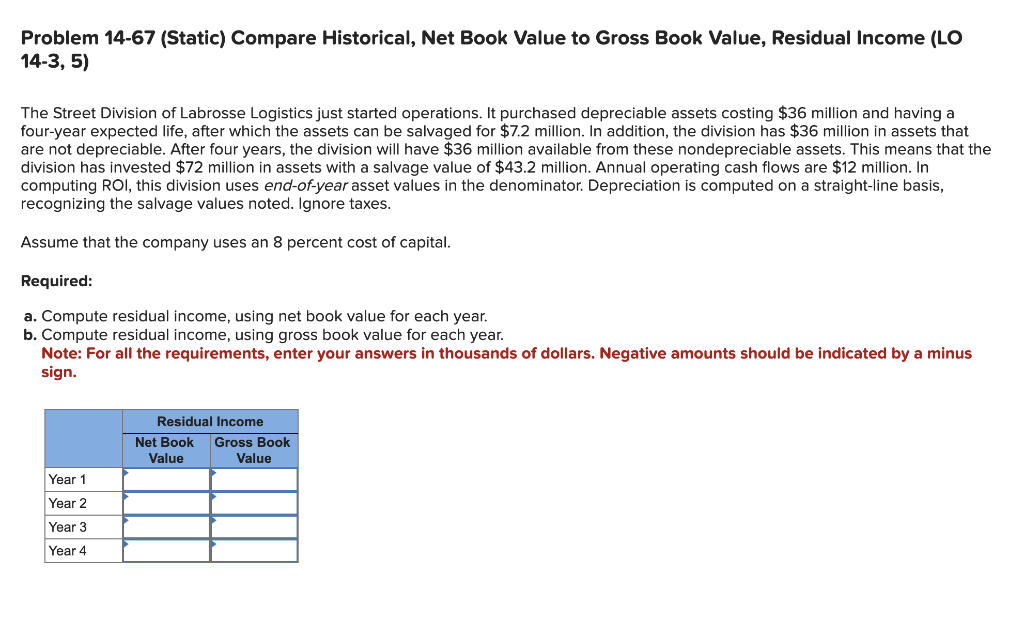

Problem 14-67 (Static) Compare Historical, Net Book Value to Gross Book Value, Residual Income (LO 14-3, 5) The Street Division of Labrosse Logistics just started operations. It purchased depreciable assets costing $36 million and having a four-year expected life, after which the assets can be salvaged for $7.2 million. In addition, the division has $36 million in assets that are not depreciable. After four years, the division will have $36 million available from these nondepreciable assets. This means that the division has invested $72 million in assets with a salvage value of $43.2 million. Annual operating cash flows are $12 million. In computing ROI, this division uses end-of-year asset values in the denominator. Depreciation is computed on a straight-line basis, recognizing the salvage values noted. Ignore taxes. Assume that the company uses an 8 percent cost of capital. Required: a. Compute residual income, using net book value for each year. b. Compute residual income, using gross book value for each year. Note: For all the requirements, enter your answers in thousands of dollars. Negative amounts should be indicated by a minus sign

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts