Question: Problem 1 4 - 6 7 ( Algo ) Compare Historical, Net Book Value to Gross Book Value, Residual Income ( LO 1 4 -

Problem Algo Compare Historical, Net Book Value to Gross Book Value, Residual Income LO

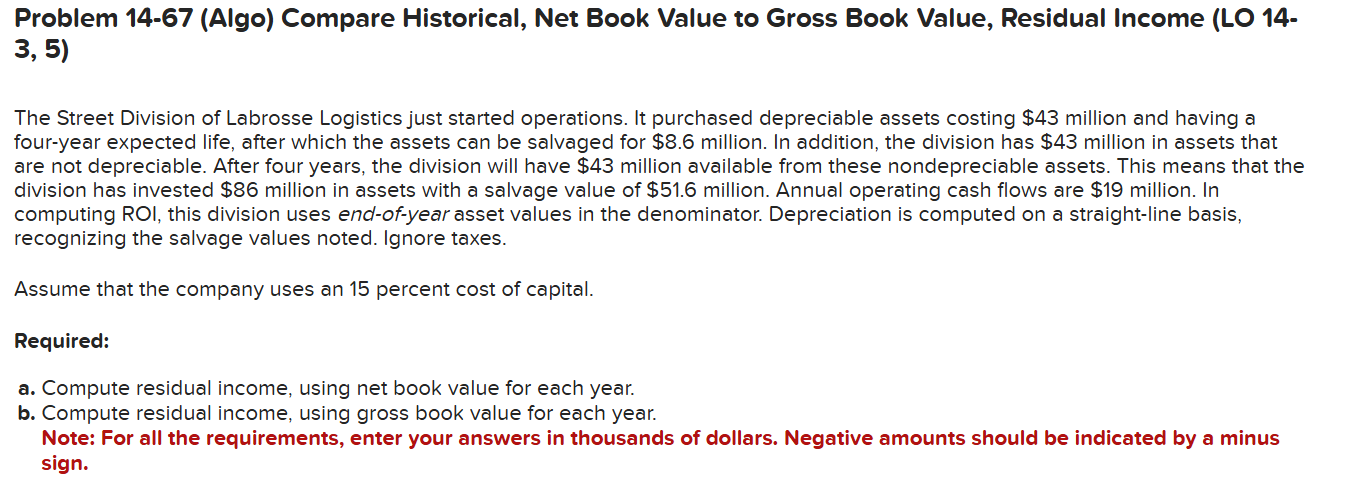

The Street Division of Labrosse Logistics just started operations. It purchased depreciable assets costing $ million and having a fouryear expected life, after which the assets can be salvaged for $ million. In addition, the division has $ million in assets that are not depreciable. After four years, the division will have $ million available from these nondepreciable assets. This means that the division has invested $ million in assets with a salvage value of $ million. Annual operating cash flows are $ million. In computing ROI, this division usesendofyearasset values in the denominator. Depreciation is computed on a straightline basis, recognizing the salvage values noted. Ignore taxes.

Assume that the company uses an percent cost of capital.

Required:

Compute residual income, using net book value for each year.

Compute residual income, using gross book value for each year.

Note: For all the requirements, enter your answers in thousands of dollars. Negative amounts should be indicated by a minus sign. Problem Algo Compare Historical, Net Book Value to Gross Book Value, Residual Income LO

The Street Division of Labrosse Logistics just started operations. It purchased depreciable assets costing $ million and having a fouryear expected life, after which the assets can be salvaged for $ million. In addition, the division has $ million in assets that are not depreciable. After four years, the division will have $ million available from these nondepreciable assets. This means that the division has invested $ million in assets with a salvage value of $ million. Annual operating cash flows are $ million. In computing ROI, this division uses endofyear asset values in the denominator. Depreciation is computed on a straightline basis, recognizing the salvage values noted. Ignore taxes.

Assume that the company uses an percent cost of capital.

Required:

a Compute residual income, using net book value for each year.

b Compute residual income, using gross book value for each year.

Note: For all the requirements, enter your answers in thousands of dollars. Negative amounts should be indicated by a minus sign.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock