Question: please show how to do the last three please and thank you. you can do it all if you would like and it would be

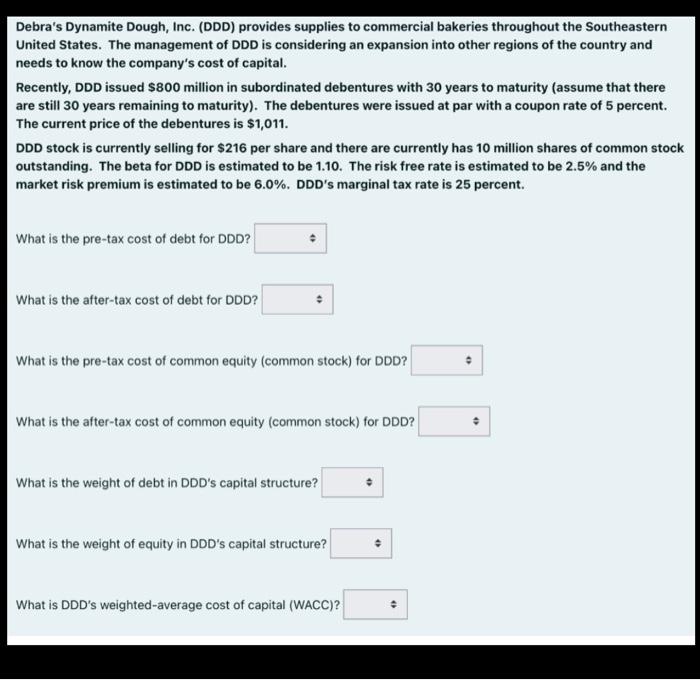

Debra's Dynamite Dough, Inc. (DDD) provides supplies to commercial bakeries throughout the Southeastern United States. The management of DDD is considering an expansion into other regions of the country and needs to know the company's cost of capital. Recently, DDD issued $800 million in subordinated debentures with 30 years to maturity (assume that there are still 30 years remaining to maturity). The debentures were issued at par with a coupon rate of 5 percent. The current price of the debentures is $1,011. DDD stock is currently selling for $216 per share and there are currently has 10 million shares of common stock outstanding. The beta for DDD is estimated to be 1.10. The risk free rate is estimated to be 2.5% and the market risk premium is estimated to be 6.0%. DDD's marginal tax rate is 25 percent. What is the pre-tax cost of debt for DDD? What is the after-tax cost of debt for DDD? What is the pre-tax cost of common equity (common stock) for DDD? What is the after-tax cost of common equity (common stock) for DDD? What is the weight of debt in DDD's capital structure? What is the weight of equity in DDD's capital structure? . What is DDD's weighted-average cost of capital (WACC)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts