Question: Please show how to get beginning net asset and beginning net monetary liability. Thank you Rolfe Company (a U.S.-based company) has a subsidiary in Nigeria

Please show how to get beginning net asset and beginning net monetary liability. Thank you

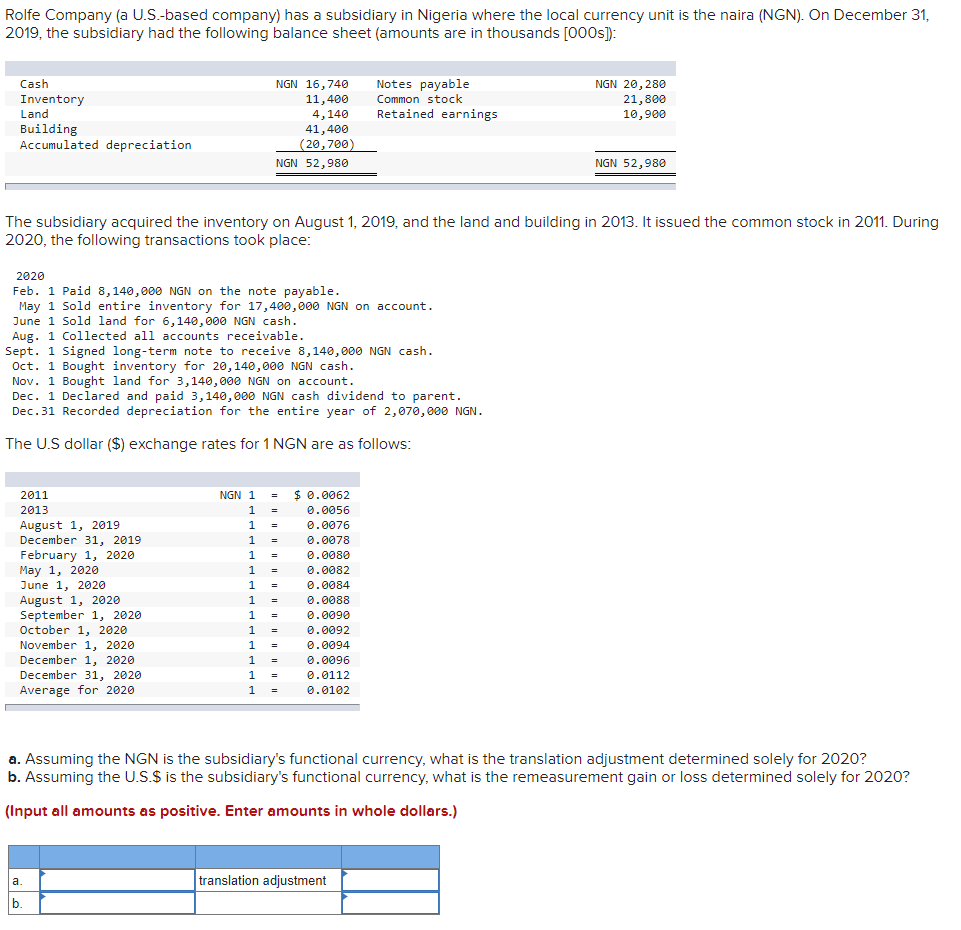

Rolfe Company (a U.S.-based company) has a subsidiary in Nigeria where the local currency unit is the naira (NGN). On December 31 , 2019, the subsidiary had the following balance sheet (amounts are in thousands [000s]): The subsidiary acquired the inventory on August 1, 2019, and the land and building in 2013. It issued the common stock in 2011. During 2020 , the following transactions took place: 2020 Feb. 1 Paid 8,140,000 NGN on the note payable. May 1 Sold entire inventory for 17,400,000 NGN on account. June 1 Sold land for 6,140,000 NGN cash. Aug. 1 Collected all accounts receivable. Sept. 1 Signed long-term note to receive 8,140,000 NGN cash. Oct. 1 Bought inventory for 20,140,000 NGN cash. Nov. 1 Bought land for 3,140,000NGN on account. Dec. 1 Declared and paid 3,140,000 NGN cash dividend to parent. Dec.31 Recorded depreciation for the entire year of 2,070,000 NGN. The U.S dollar (\$) exchange rates for 1NGN are as follows: a. Assuming the NGN is the subsidiary's functional currency, what is the translation adjustment determined solely for 2020 ? b. Assuming the U.S.\$ is the subsidiary's functional currency, what is the remeasurement gain or loss determined solely for 2020 ? (Input all amounts as positive. Enter amounts in whole dollars.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts