Question: please show how to get the answer in part c) 0.0355** standard deviations are correct, they will help you find the answer. Use the accompanying

please show how to get the answer in part c) 0.0355**

please show how to get the answer in part c) 0.0355**

standard deviations are correct, they will help you find the answer.

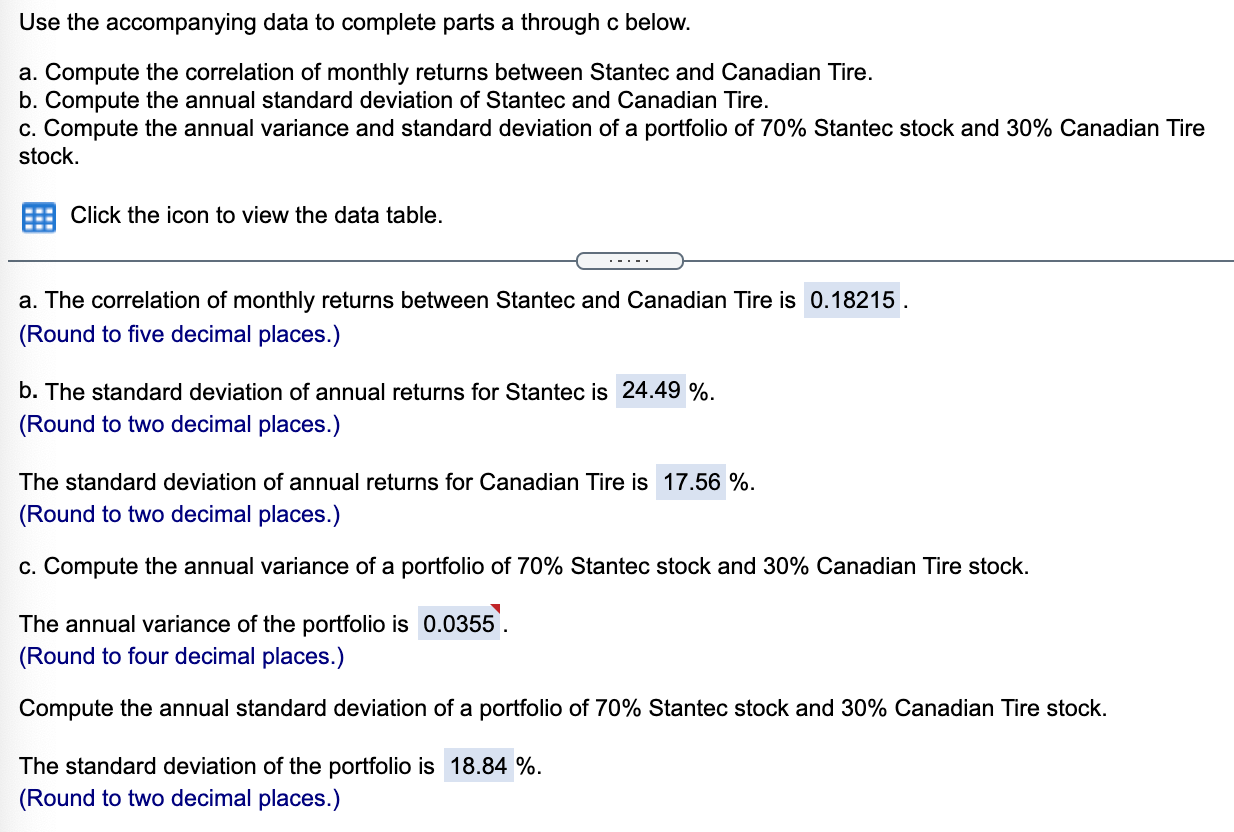

Use the accompanying data to complete parts a through c below. a. Compute the correlation of monthly returns between Stantec and Canadian Tire. b. Compute the annual standard deviation of Stantec and Canadian Tire. c. Compute the annual variance and standard deviation of a portfolio of 70% Stantec stock and 30% Canadian Tire stock. Click the icon to view the data table. a. The correlation of monthly returns between Stantec and Canadian Tire is 0.18215 . (Round to five decimal places.) b. The standard deviation of annual returns for Stantec is 24.49 %. (Round to two decimal places.) The standard deviation of annual returns for Canadian Tire is 17.56 %. (Round to two decimal places.) c. Compute the annual variance of a portfolio of 70% Stantec stock and 30% Canadian Tire stock. The annual variance of the portfolio is 0.0355 (Round to four decimal places.) Compute the annual standard deviation of a portfolio of 70% Stantec stock and 30% Canadian Tire stock. The standard deviation of the portfolio is 18.84 %. (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts