Question: Please show how to solve these problems. thank you In March of 2019, Boyet Corporation purchased nontrading equity investments which are irrevocably designated at FV-OCI.

Please show how to solve these problems. thank you

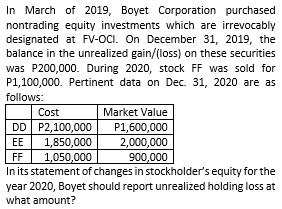

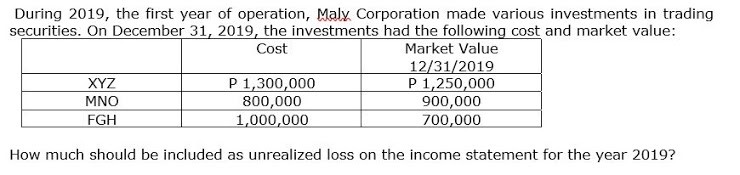

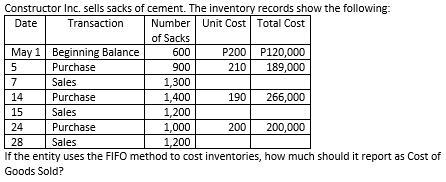

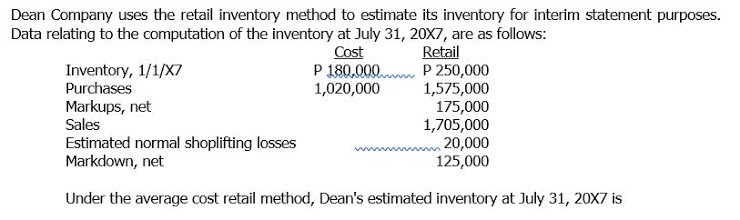

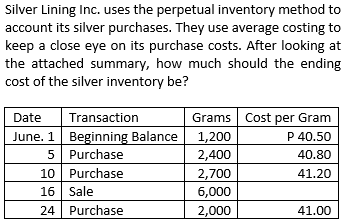

In March of 2019, Boyet Corporation purchased nontrading equity investments which are irrevocably designated at FV-OCI. On December 31, 2019, the balance in the unrealized gain/(loss) on these securities was P200,000. During 2020, stock FF was sold for P1,100,000. Pertinent data on Dec. 31, 2020 are as follows: Cost Market Value DD P2,100,000 P1,600,000 EE 1,850,000 2,000,000 FF 1,050,000 900,000 In its statement of changes in stockholder's equity for the year 2020, Boyet should report unrealized holding loss at what amount?During 2019, the first year of operation, Maly Corporation made various investments in trading securities. On December 31, 2019, the investments had the following cost and market value: Cost Market Value 12/31/2019 XYZ P 1,300,000 P 1,250,000 MNO 800,000 900,000 FGH 1,000,000 700,000 How much should be included as unrealized loss on the income statement for the year 2019?Constructor Inc. sells sacks of cement. The inventory records show the following: Date Transaction Number Unit Cost Total Cost of Sacks May 1 Beginning Balance 600 P200 P120,000 5 Purchase 900 210 189,000 7 Sales 1,300 14 Purchase 1,400 190 266,000 15 Sales 1 200 24 Purchase 1,000 200 200,000 28 Sales 1,200 If the entity uses the FIFO method to cost inventories, how much should it report as Cost of Goods Sold?Dean Company uses the retail inventory method to estimate its inventory for interim statement purposes. Data relating to the computation of the inventory at July 31, 20X7, are as follows: Cost Retail Inventory, 1/1/X7 P 180,000 P 250,000 Purchases 1,020,000 1,575,000 Markups, net 175,000 Sales 1,705,000 Estimated normal shoplifting losses 20,000 Markdown, net 125,000 Under the average cost retail method, Dean's estimated inventory at July 31, 20X7 isSilver Lining Inc. uses the perpetual inventory.r method to account its silver purchases. They use average costing to keep a close eve on its purchase costs. After looking at the attached summarv, how much should the ending cost of the silver inVEHtDW be? Cost per Gram .1 1,200 P4050 40-80 2 41-20 24 2. 41.00