Refer to the facts in Tax Form/Return Preparation Problem C:9-58. Now assume the company is an S

Question:

Refer to the facts in Tax Form/Return Preparation Problem C:9-58. Now assume the company is an S corporation rather than a partnership. Additional facts are as follows:

- Drs. Bailey and Firth formed the corporation on January 1, 2018, and the corporation immediately elected S corporation status effective at the beginning of 2018.

- Upon formation of the corporation, Dr. Bailey received common stock worth $1.2 million, and Dr. Firth received common stock worth $2.8 million.

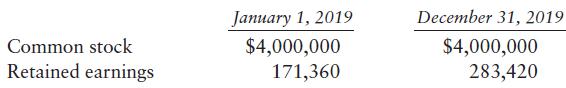

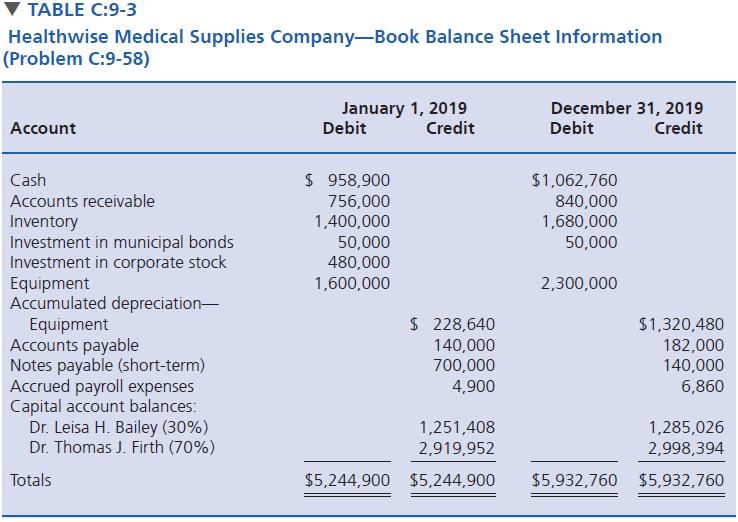

- The balance sheet information is the same as in Table C:9-3 except the equity section is as follows:

- The $200,000 paid to Dr. Bailey is salary constituting W-2 wages (instead of a guaranteed payment). Ignore employment taxes (Social Security, etc.) on Dr. Bailey’s salary.

- Use book numbers for Schedule L and Schedule M-1 in Form 1120-S.

Required:

Prepare the 2019 S corporation tax return (Form 1120-S), including the following additional schedules and forms: Schedule D, Form 4562, and Schedule K-1.

Optional:

(1) Complete Schedule M-2 in Form 1120-S even though the company has never been a C corporation. For this purpose, the accumulated adjustments account at the beginning of 2019 is $171,360.

(2) Prepare a schedule for each shareholder’s basis in his or her S corporation stock. For this purpose, Bailey’s stock basis at the beginning of 2019 is $1,251,408 and Firth’s is $2,535,952.

Step by Step Answer:

Federal Taxation 2021 Corporations, Partnerships, Estates & Trusts

ISBN: 9780135919460

34th Edition

Authors: Timothy J. Rupert, Kenneth E. Anderson, David S. Hulse