Question: Please show how you calculated each input Balance sheet Problem #1 Create a properly formatted Income Statement (including earnings per share) for HW Enterprises from

Please show how you calculated each input

Balance sheet

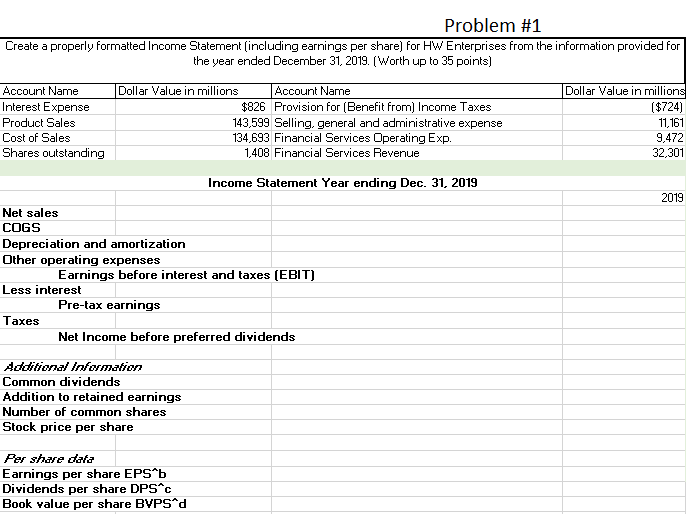

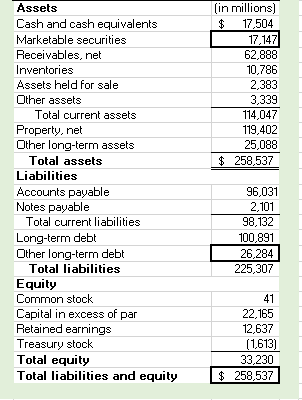

Problem #1 Create a properly formatted Income Statement (including earnings per share) for HW Enterprises from the information provided for the year ended December 31, 2019. (Worth up to 35 points) Account Name Interest Expense Product Sales Cost of Sales Shares outstanding Dollar Value in millions Account Name $826 Provision for (Benefit from) Income Taxes 143,599 Selling, general and administrative expense 134,693 Financial Services Operating Exp. 1,408 Financial Services Revenue Dollar Value in millions ($724) 11,161 9,472 32,301 Income Statement Year ending Dec. 31, 2019 2019 Net sales COGS Depreciation and amortization Other operating expenses Earnings before interest and taxes (EBIT) Less interest Pre-tax earnings Taxes Net Income before preferred dividends Additional Information Common dividends Addition to retained earnings Number of common shares Stock price per share Per share data Earnings per share EPS b Dividends per share DPSC Book value per share BVPS d (in millions) $ 17,504 17,147 62,888 10,786 2,383 3,339 114,047 119,402 25,088 $ 258,537 Assets Cash and cash equivalents Marketable securities Receivables, net Inventories Assets held for sale Other assets Total current assets Property, net Other long-term assets Total assets Liabilities Accounts payable Notes payable Total current liabilities Long-term debt Other long-term debt Total liabilities Equity Common stock Capital in excess of par Retained earnings Treasury stock Total equity Total liabilities and equity 96,031 2,101 98,132 100,891 26,284 225,307 41 22,165 12,637 (1,613) 33,230 $ 258,537

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts