Question: Please show how you get the answer on Excel. Thank you. Last year's simplified financial statements for Adeyemi Cycles are shown below. Assume there are

Please show how you get the answer on Excel. Thank you.

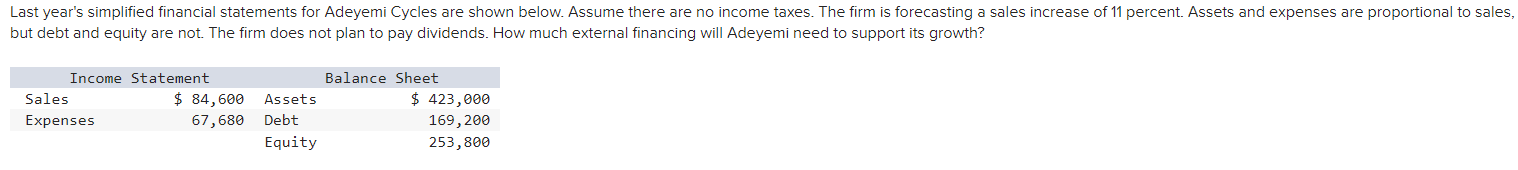

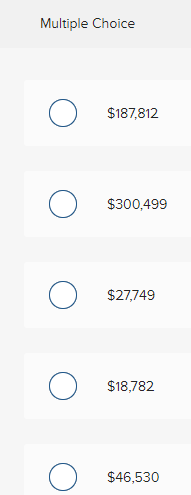

Last year's simplified financial statements for Adeyemi Cycles are shown below. Assume there are no income taxes. The firm is forecasting a sales increase of 11 percent. Assets and expenses are proportional to sales, but debt and equity are not. The firm does not plan to pay dividends. How much external financing will Adeyemi need to support its growth? Income Statement Sales $ 84,600 Expenses 67,680 Balance Sheet Assets $ 423,000 Debt 169,200 Equity 253,800 Multiple Choice $187,812 $300,499 $27,749 $18,782 $46,530

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts