Question: please show how you got each answer i need help with all of these! Douglas Keel, a financial analyst for Orange Industries, wishes to estimate

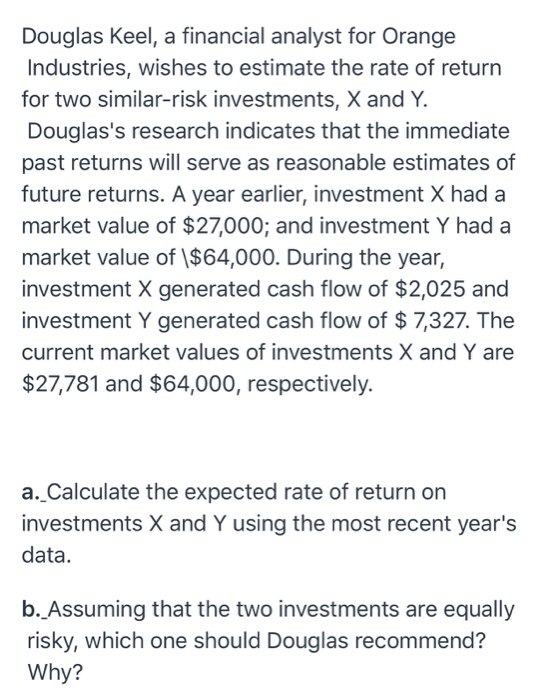

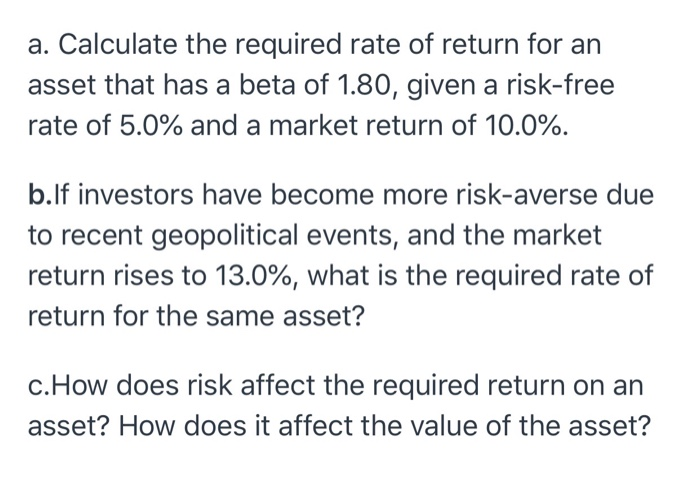

Douglas Keel, a financial analyst for Orange Industries, wishes to estimate the rate of return for two similar-risk investments, X and Y. Douglas's research indicates that the immediate past returns will serve as reasonable estimates of future returns. A year earlier, investment X had a market value of $27,000; and investment Y had a market value of $64,000. During the year, investment X generated cash flow of $2,025 and investment Y generated cash flow of $ 7,327. The current market values of investments X and Y are $27,781 and $64,000, respectively. a. Calculate the expected rate of return on investments X and Y using the most recent year's data. b. Assuming that the two investments are equally risky, which one should Douglas recommend? Why? a. Calculate the required rate of return for an asset that has a beta of 1.80, given a risk-free rate of 5.0% and a market return of 10.0%. b.If investors have become more risk-averse due to recent geopolitical events, and the market return rises to 13.0%, what is the required rate of return for the same asset? c.How does risk affect the required return on an asset? How does it affect the value of the asset

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts