Question: Please show in Excel A company project has an initial cost of $40,000, expected net cash flows of $9,000 per year for 7 years. The

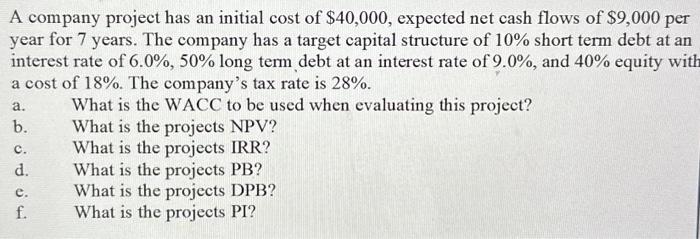

A company project has an initial cost of $40,000, expected net cash flows of $9,000 per year for 7 years. The company has a target capital structure of 10% short term debt at an interest rate of 6.0%,50% long term debt at an interest rate of 9.0%, and 40% equity witl a cost of 18%. The company's tax rate is 28%. a. What is the WACC to be used when evaluating this project? b. What is the projects NPV? c. What is the projects IRR? d. What is the projects PB? e. What is the projects DPB? f. What is the projects PI

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts