Question: Please show in excel spreadsheet with functions if possible, thank you! Mega Question: The following questions are related to these inputs. Each question is a

Please show in excel spreadsheet with functions if possible, thank you!

Please show in excel spreadsheet with functions if possible, thank you!

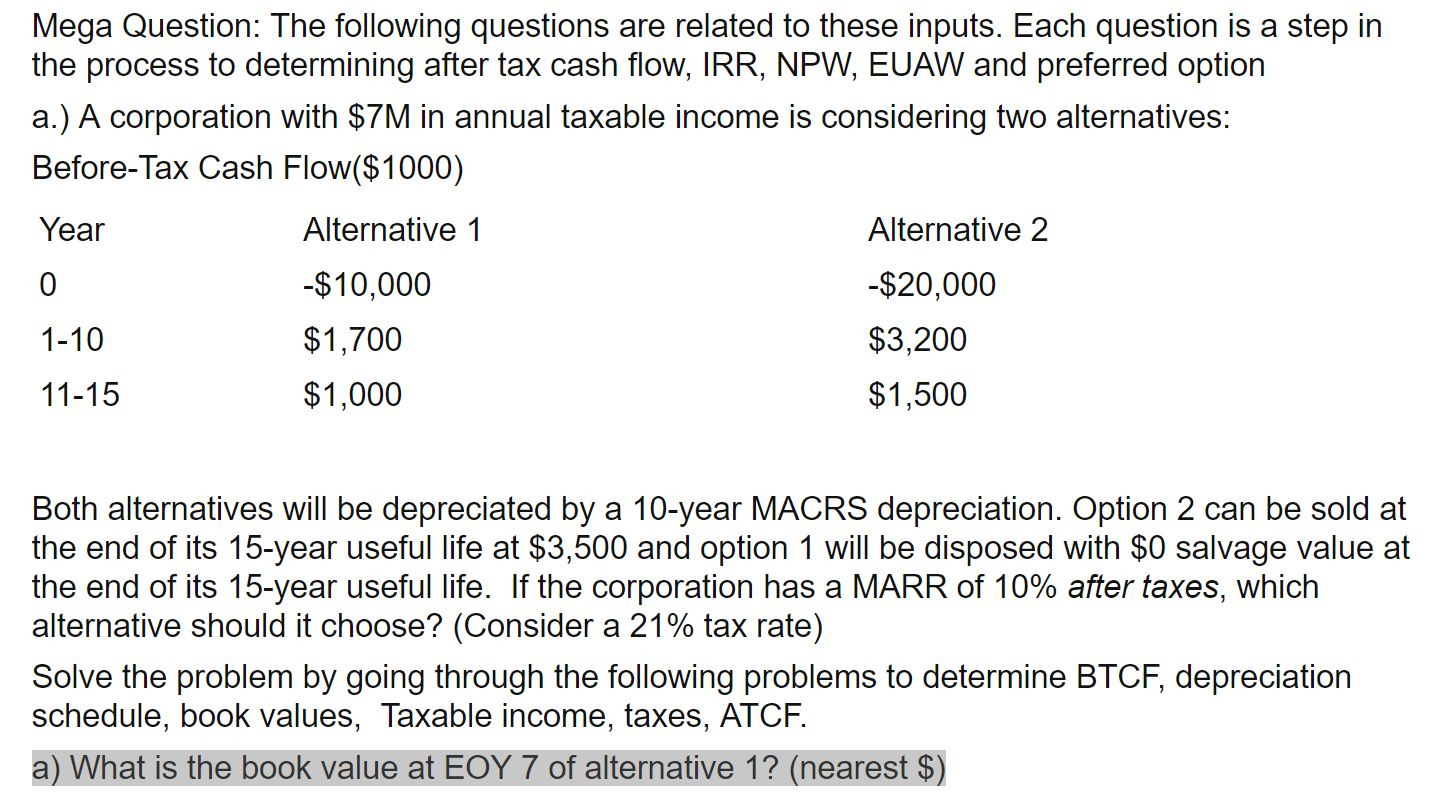

Mega Question: The following questions are related to these inputs. Each question is a step in the process to determining after tax cash flow, IRR, NPW, EUAW and preferred option a.) A corporation with $7M in annual taxable income is considering two alternatives: Before-Tax Cash Flow($1000) Year Alternative 1 Alternative 2 -$10,000 -$20,000 $1,700 $3,200 11-15 $1,000 $1,500 1-10 Both alternatives will be depreciated by a 10-year MACRS depreciation. Option 2 can be sold at the end of its 15-year useful life at $3,500 and option 1 will be disposed with $0 salvage value at the end of its 15-year useful life. If the corporation has a MARR of 10% after taxes, which alternative should it choose? (Consider a 21% tax rate) Solve the problem by going through the following problems to determine BTCF, depreciation schedule, book values, Taxable income, taxes, ATCF. a) What is the book value at EOY 7 of alternative 1? (nearest $)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts