Question: QUESTION 1 Zero rates in both the US and Britain are flat at 5% per annum with annual compounding. In a differential swap (meaning: an

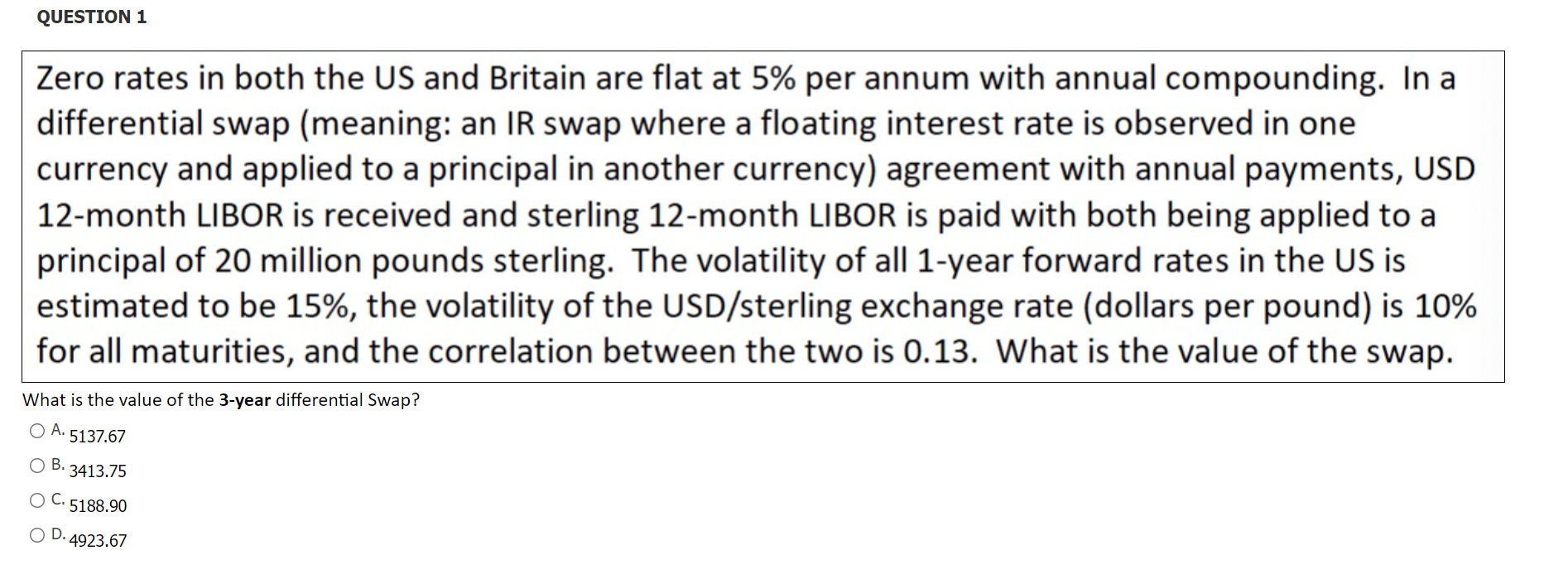

QUESTION 1 Zero rates in both the US and Britain are flat at 5% per annum with annual compounding. In a differential swap (meaning: an IR swap where a floating interest rate is observed in one currency and applied to a principal in another currency) agreement with annual payments, USD 12-month LIBOR is received and sterling 12-month LIBOR is paid with both being applied to a principal of 20 million pounds sterling. The volatility of all 1-year forward rates in the US is estimated to be 15%, the volatility of the USD/sterling exchange rate (dollars per pound) is 10% for all maturities, and the correlation between the two is 0.13. What is the value of the swap. What is the value of the 3-year differential Swap? O A. 5137.67 OB. 3413.75 OC. 5188.90 OD. 4923.67 QUESTION 1 Zero rates in both the US and Britain are flat at 5% per annum with annual compounding. In a differential swap (meaning: an IR swap where a floating interest rate is observed in one currency and applied to a principal in another currency) agreement with annual payments, USD 12-month LIBOR is received and sterling 12-month LIBOR is paid with both being applied to a principal of 20 million pounds sterling. The volatility of all 1-year forward rates in the US is estimated to be 15%, the volatility of the USD/sterling exchange rate (dollars per pound) is 10% for all maturities, and the correlation between the two is 0.13. What is the value of the swap. What is the value of the 3-year differential Swap? O A. 5137.67 OB. 3413.75 OC. 5188.90 OD. 4923.67

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts