Question: PLEASE SHOW IN EXCEL TEMPLATE. 2. You have been asked to calculate the cost of equity for three firms - Eastern, Western, and Northern. You

PLEASE SHOW IN EXCEL TEMPLATE.

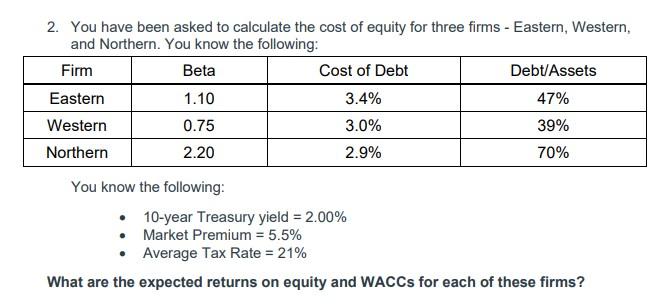

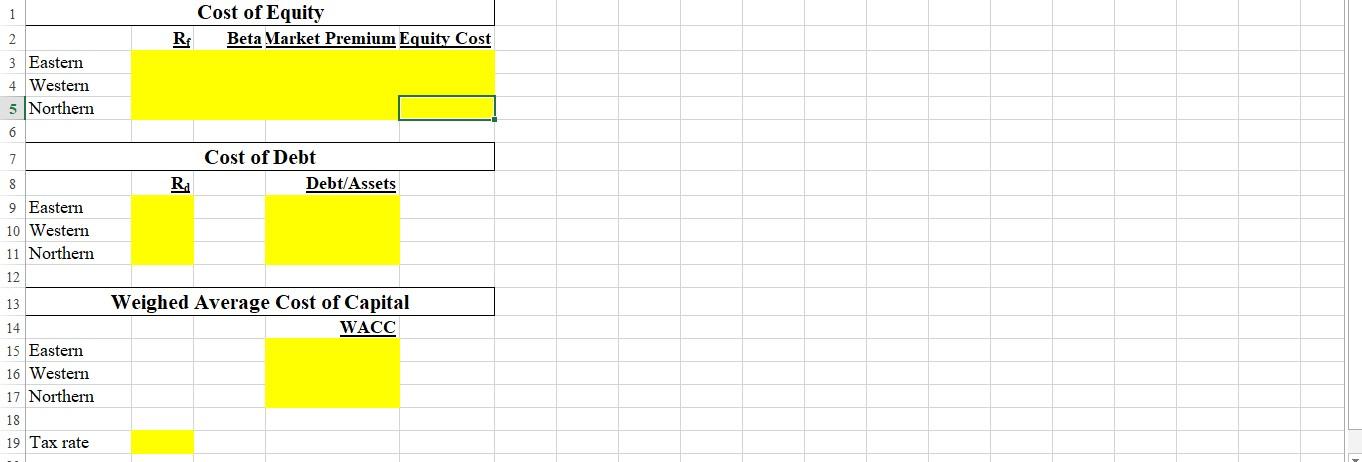

2. You have been asked to calculate the cost of equity for three firms - Eastern, Western, and Northern. You know the following: Firm Beta Cost of Debt Debt/Assets Eastern 1.10 3.4% 47% Western 0.75 3.0% 39% Northern 2.20 2.9% 70% You know the following: 10-year Treasury yield = 2.00% Market Premium = 5.5% Average Tax Rate = 21% What are the expected returns on equity and WACCs for each of these firms? 1 Cost of Equity RE Beta Market Premium Equity Cost 2 3 Eastern 4 Western 5 Northern 6 7 Cost of Debt Debt/Assets R 8 9 Eastern 10 Western 11 Northern 12 Weighed Average Cost of Capital WACC 13 14 15 Eastern 16 Western 17 Northern 18 19 Tax rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts