Question: Please show in excel with formulas Based on this information, use the strike price 99.5 and compute both the payoff and the profit from buying

Please show in excel with formulas

Based on this information, use the strike price 99.5 and compute both the payoff and the profit from buying that call option. Assume that the investor is correct about the price of the bond next year.

Based on this information, use the strike price 99.5 and compute both the payoff and the profit from buying that call option. Assume that the investor is correct about the price of the bond next year.

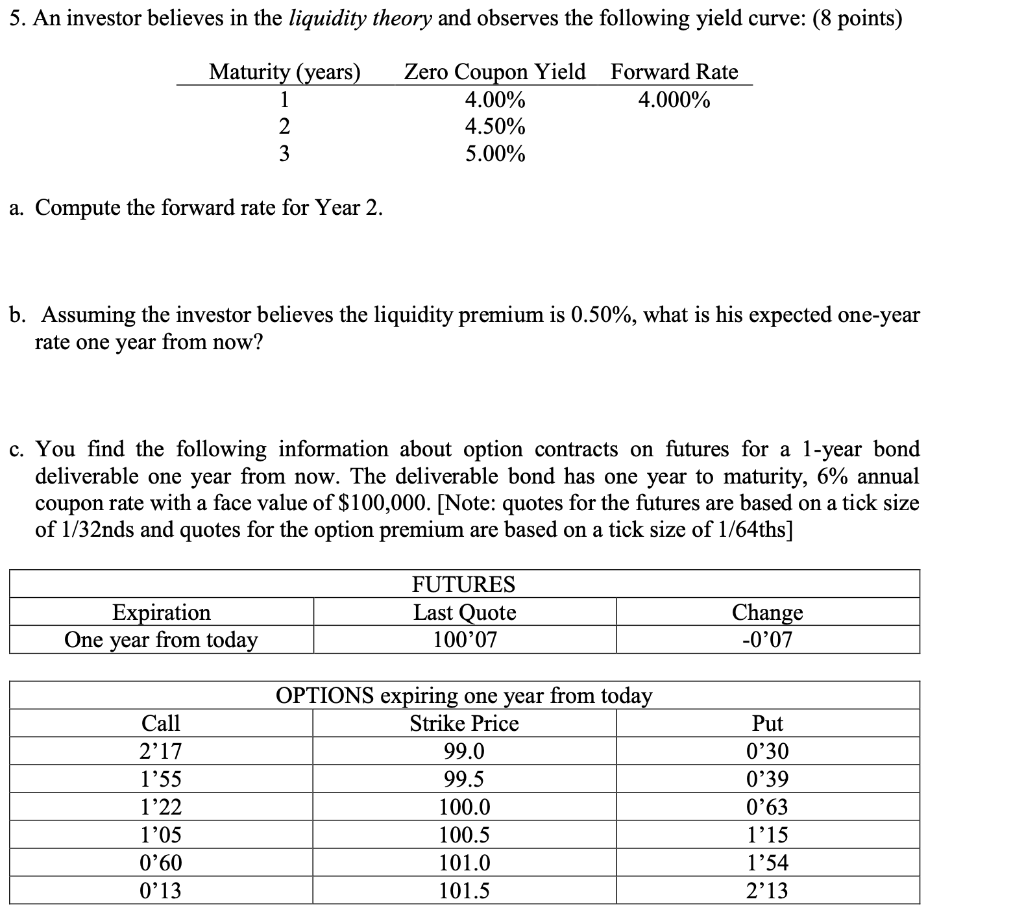

5. An investor believes in the liquidity theory and observes the following yield curve: (8 points) Forward Rate 4.000% Maturity (years) 1 2 3 Zero Coupon Yield 4.00% 4.50% 5.00% a. Compute the forward rate for Year 2. b. Assuming the investor believes the liquidity premium is 0.50%, what is his expected one-year rate one year from now? c. You find the following information about option contracts on futures for a 1-year bond deliverable one year from now. The deliverable bond has one year to maturity, 6% annual coupon rate with a face value of $100,000. [Note: quotes for the futures are based on a tick size of 1/32nds and quotes for the option premium are based on a tick size of 1/64ths] Expiration One year from today FUTURES Last Quote 100'07 Change -0'07 Call 2'17 1'55 1'22 1'05 0'60 0'13 OPTIONS expiring one year from today Strike Price 99.0 99.5 100.0 100.5 101.0 101.5 Put 0'30 0'39 0'63 1'15 1'54 2'13 5. An investor believes in the liquidity theory and observes the following yield curve: (8 points) Forward Rate 4.000% Maturity (years) 1 2 3 Zero Coupon Yield 4.00% 4.50% 5.00% a. Compute the forward rate for Year 2. b. Assuming the investor believes the liquidity premium is 0.50%, what is his expected one-year rate one year from now? c. You find the following information about option contracts on futures for a 1-year bond deliverable one year from now. The deliverable bond has one year to maturity, 6% annual coupon rate with a face value of $100,000. [Note: quotes for the futures are based on a tick size of 1/32nds and quotes for the option premium are based on a tick size of 1/64ths] Expiration One year from today FUTURES Last Quote 100'07 Change -0'07 Call 2'17 1'55 1'22 1'05 0'60 0'13 OPTIONS expiring one year from today Strike Price 99.0 99.5 100.0 100.5 101.0 101.5 Put 0'30 0'39 0'63 1'15 1'54 2'13

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts