Question: PLEASE SHOW ME HOW TO DO IT ON EXCEL!!! I UNDERSTAND HOW TO DO IT BY HAND, PLEASE SCREENSHOT AND SHOW ME TABLES ON EXCEL.

PLEASE SHOW ME HOW TO DO IT ON EXCEL!!!

I UNDERSTAND HOW TO DO IT BY HAND, PLEASE SCREENSHOT AND SHOW ME TABLES ON EXCEL.

I found the correct value of the required rate of return and the dividends. I also then used the constant growth rate. 3.08/(.123-.07) = 58.11 and then I believe I have to add back in the dividend from year 2? So that equals 60.99. I am trying to then use the NPV function in Excel but it isn't giving me the right answer.

I put in =NPV(0.123, 2.4, 2.88, 60.99) and it gives me $47.49 which is incorrect.

Correct answer is $50.50 but I just want to know how to get there using Excel. Thanks!

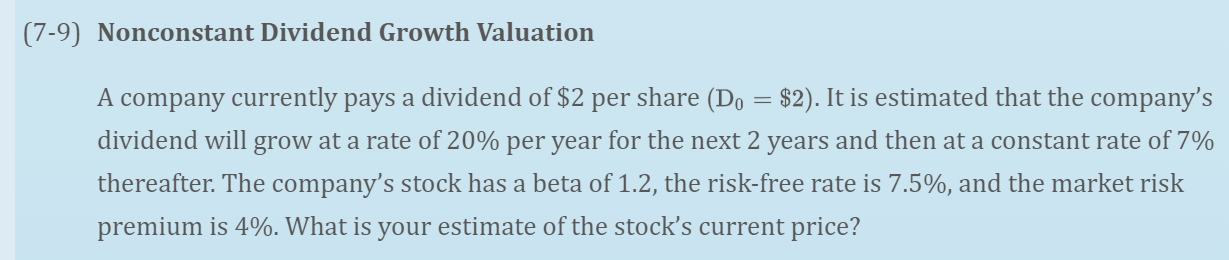

(7-9) Nonconstant Dividend Growth Valuation A company currently pays a dividend of $2 per share (Do = $2). It is estimated that the company's dividend will grow at a rate of 20% per year for the next 2 years and then at a constant rate of 7% thereafter. The company's stock has a beta of 1.2, the risk-free rate is 7.5%, and the market risk premium is 4%. What is your estimate of the stock's current price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts