Question: Please show me how to do the first couple of months, and I will figure out the rest. It is just really confusing for me.

Please show me how to do the first couple of months, and I will figure out the rest. It is just really confusing for me.

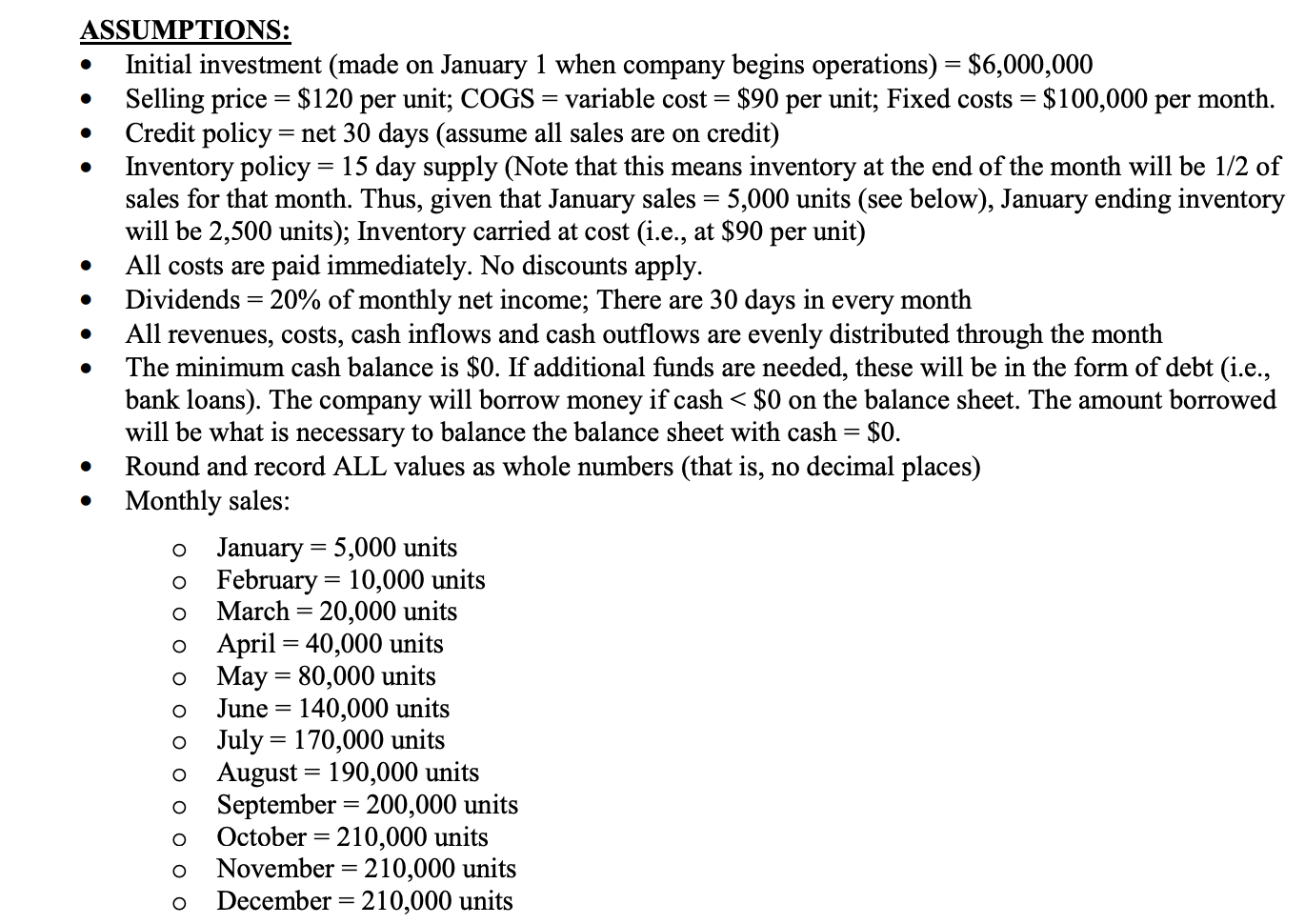

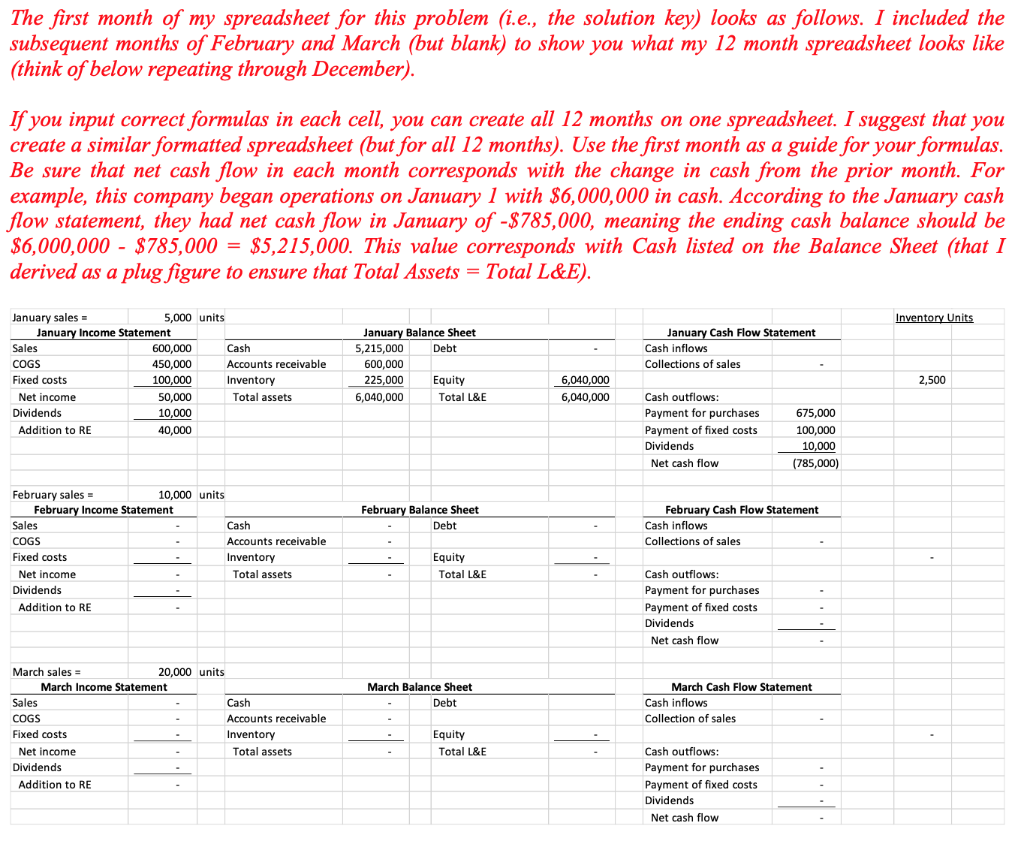

ASSUMPTIONS: Initial investment (made on January 1 when company begins operations) = $6,000,000 Selling price = $120 per unit; COGS = variable cost = $90 per unit; Fixed costs = $100,000 per month. Credit policy= net 30 days (assume all sales are on credit) Inventory policy = 15 day supply (Note that this means inventory at the end of the month will be 1/2 of sales for that month. Thus, given that January sales = 5,000 units (see below), January ending inventory will be 2,500 units); Inventory carried at cost (i.e., at $90 per unit) All costs are paid immediately. No discounts apply. Dividends = 20% of monthly net income; There are 30 days in every month All revenues, costs, cash inflows and cash outflows are evenly distributed through the month The minimum cash balance is $0. If additional funds are needed, these will be in the form of debt (i.e., bank loans). The company will borrow money if cash

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts