Question: Please show me how to solve using the TI BA II Plus calculator. 6. 6. A firm is considering a project that is expected to

Please show me how to solve using the TI BA II Plus calculator.

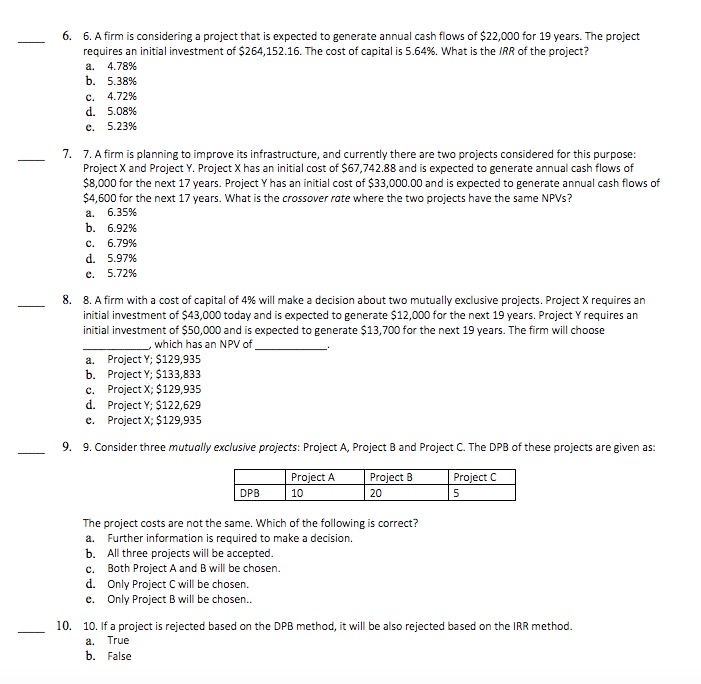

6. 6. A firm is considering a project that is expected to generate annual cash flows of $22,000 for 19 years. The project requires an initial investment of $264,152.16. The cost of capital is 5.64%, what is the IRR of the project? a. 4.78% b. 5.38% . 4.72% d. 5.08% e. 5.23% 7. 7. A firm is planning to improve its infrastructure, and currently there are two projects considered for this purpose Project X and Project Y. Project X has an initial cost of $67,742.88 and is expected to generate annual cash flows of $8,000 for the next 17 years. Project Y has an initial cost of $33,000.00 and is expected to generate annual cash flows of $4,600 for the next 17 years. What is the crossover rate where the two projects have the same NPVs? a. 6.35% b. 6.92% c. 6.79% d. 5.97% e. 5.72% 8, 8. A firm with a cost of capital of 4% will make a decision about two mutually exclusive projects. Project X requires an initial investment of $43,000 today and is expected to generate $12,000 for the next 19 years. Project Y requires an initial investment of $50,000 and is expected to generate $13,700 for the next 19 years. The firm will choose which has an NPV of a. b. c. d. e. Project Y; $129,935 Project Y; $133,833 Project X: $129,935 ProjectY; S122,629 Project X; $129,935 9. 9. Consider three mutually exclusive projects: Project A, Project B and Project C. The DPB of these projects are given as: Project A 10 Project B 20 Project C DPB The project costs are not the same. Which of the following is correct? a. Further information is required to make a decision. b. All three projectsl be accepted c. Both Project A and B will be chosen d. Only Project C will be chosen. e. Only Project B will be chosen.. 10. 10. If a project is rejected based on the DPB method, it will be also rejected based on the IRR method a. b. False True

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts