Question: please show me step by step how to answer this with formulation. Thank you in advance :) 3. Assume you have access to two possible

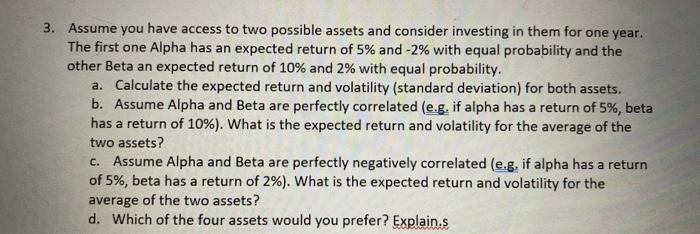

3. Assume you have access to two possible assets and consider investing in them for one year. The first one Alpha has an expected return of 5% and -2% with equal probability and the other Beta an expected return of 10% and 2% with equal probability. a. Calculate the expected return and volatility (standard deviation) for both assets. b. Assume Alpha and Beta are perfectly correlated (e.g. if alpha has a return of 5%, beta has a return of 10%). What is the expected return and volatility for the average of the two assets? c. Assume Alpha and Beta are perfectly negatively correlated (e.g. if alpha has a return of 5%, beta has a return of 2%). What is the expected return and volatility for the average of the two assets? d. Which of the four assets would you prefer? Explains

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts