Question: Please show me the correct solution and answers regarding problem 9 and 22 and please provide me a clear explanations. thank you! NAME: SECTION: SCORE:

Please show me the correct solution and answers regarding problem 9 and 22 and please provide me a clear explanations. thank you!

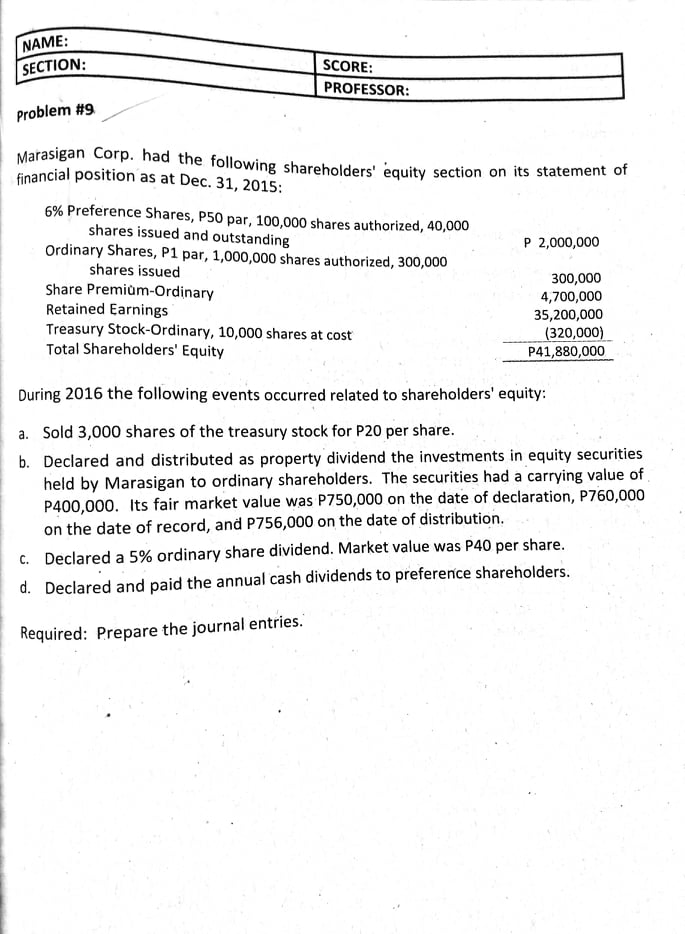

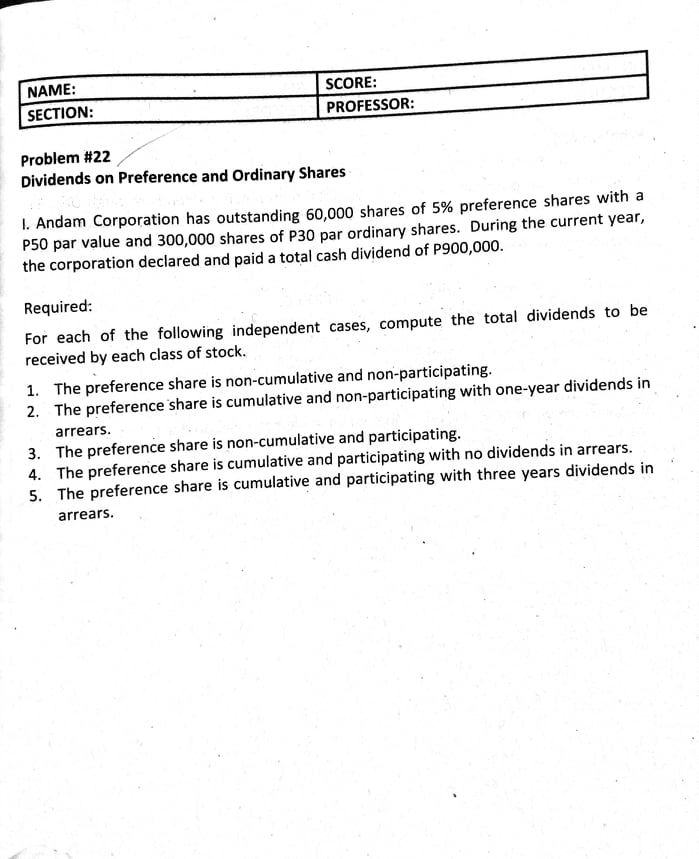

NAME: SECTION: SCORE: PROFESSOR: Problem #9 Marasigan Corp. had the following shareholders' equity section on its statement of financial position as at Dec. 31, 2015: 6% Preference Shares, P50 par, 100,000 shares authorized, 40,000 shares issued and outstanding P 2,000,000 Ordinary Shares, P1 par, 1,000,000 shares authorized, 300,000 shares issued 300,000 Share Premium-Ordinary 4,700,000 Retained Earnings 35,200,000 Treasury Stock-Ordinary, 10,000 shares at cost (320,000) Total Shareholders' Equity P41,880,000 During 2016 the following events occurred related to shareholders' equity: a. Sold 3,000 shares of the treasury stock for P20 per share. b. Declared and distributed as property dividend the investments in equity securities held by Marasigan to ordinary shareholders. The securities had a carrying value of P400,000. Its fair market value was P750,000 on the date of declaration, P760,000 on the date of record, and P756,000 on the date of distribution. C. Declared a 5% ordinary share dividend. Market value was P40 per share. d. Declared and paid the annual cash dividends to preference shareholders. Required: Prepare the journal entries.NAME: SCORE: SECTION: PROFESSOR: Problem #22 Dividends on Preference and Ordinary Shares 1. Andam Corporation has outstanding 60,000 shares of 5% preference shares with a P50 par value and 300,000 shares of P30 par ordinary shares. During the current year, the corporation declared and paid a total cash dividend of P900,000. Required: For each of the following independent cases, compute the total dividends to be received by each class of stock. 1. The preference share is non-cumulative and non-participating 2. The preference share is cumulative and non-participating with one-year dividends in arrears. 3. The preference share is non-cumulative and participating. 4. The preference share is cumulative and participating with no dividends in arrears. 5. The preference share is cumulative and participating with three years dividends in arrears

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts