Question: Please show me the excel sheet.Thank you Question 1 : Investment Advisors, Inc., is a brokerage firm that manages stock portfolios for a number of

Please show me the excel sheet.Thank you

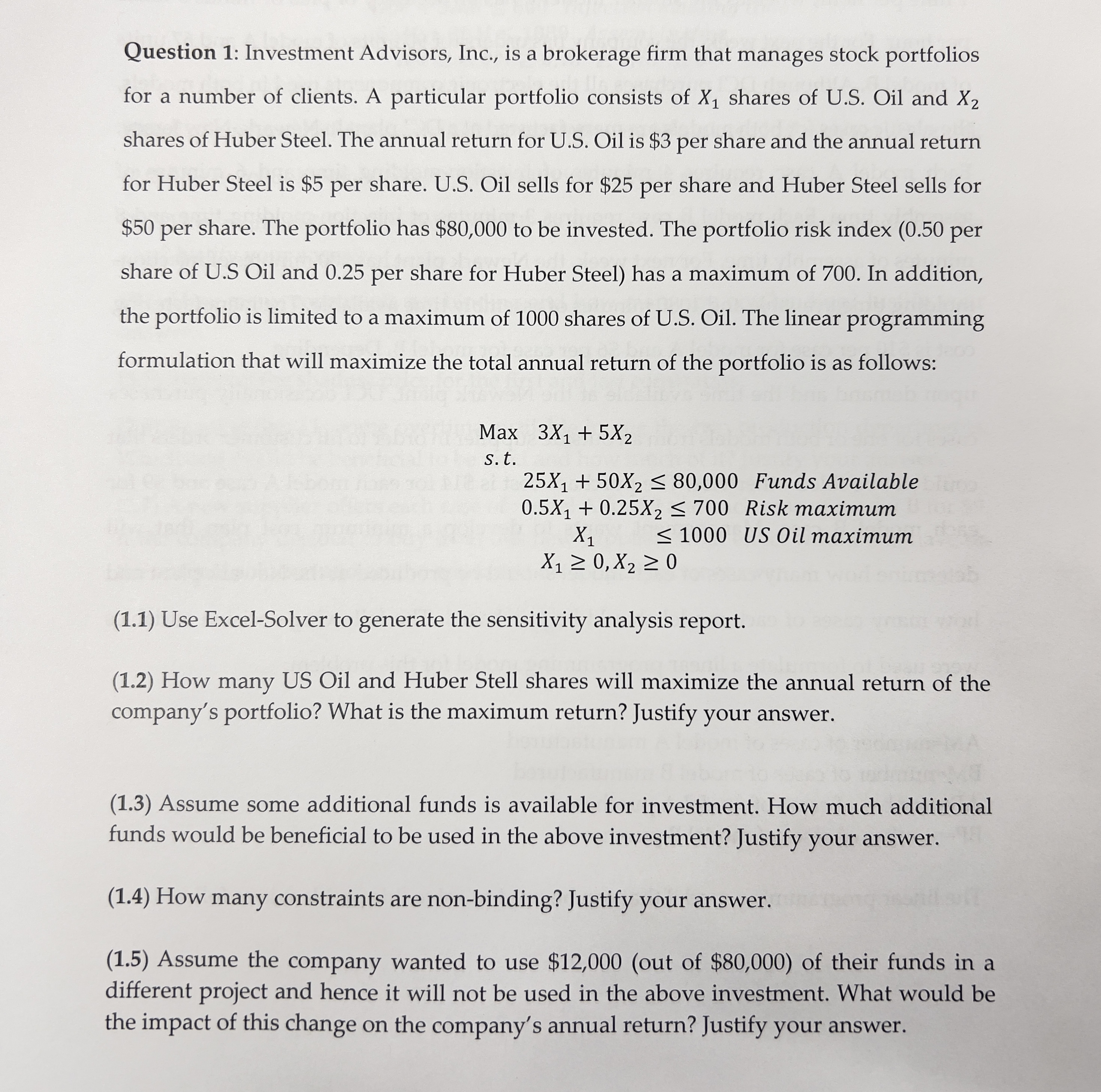

Question : Investment Advisors, Inc., is a brokerage firm that manages stock portfolios

for a number of clients. A particular portfolio consists of shares of US Oil and

shares of Huber Steel. The annual return for US Oil is $ per share and the annual return

for Huber Steel is $ per share. US Oil sells for $ per share and Huber Steel sells for

$ per share. The portfolio has $ to be invested. The portfolio risk index per

share of US Oil and per share for Huber Steel has a maximum of In addition,

the portfolio is limited to a maximum of shares of US Oil. The linear programming

formulation that will maximize the total annual return of the portfolio is as follows:

Max

Funds Available

Risk maximum

Oil maximum

Use ExcelSolver to generate the sensitivity analysis report.

How many US Oil and Huber Stell shares will maximize the annual return of the

company's portfolio? What is the maximum return? Justify your answer.

Assume some additional funds is available for investment. How much additional

funds would be beneficial to be used in the above investment? Justify your answer.

How many constraints are nonbinding? Justify your answer.

Assume the company wanted to use $out of $ of their funds in a

different project and hence it will not be used in the above investment. What would be

the impact of this change on the company's annual return? Justify your answer.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock