Question: Use excel sheet and please do attach the excel sheet for reference. 7. Investment Advisors, Inc., is a brokerage firm that manages stock portfolios for

Use excel sheet and please do attach the excel sheet for reference.

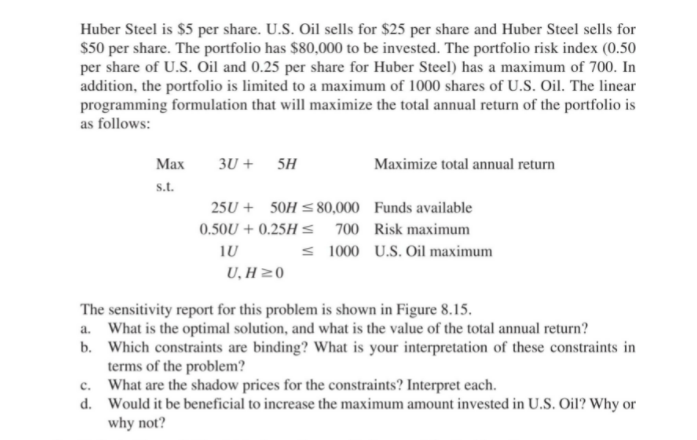

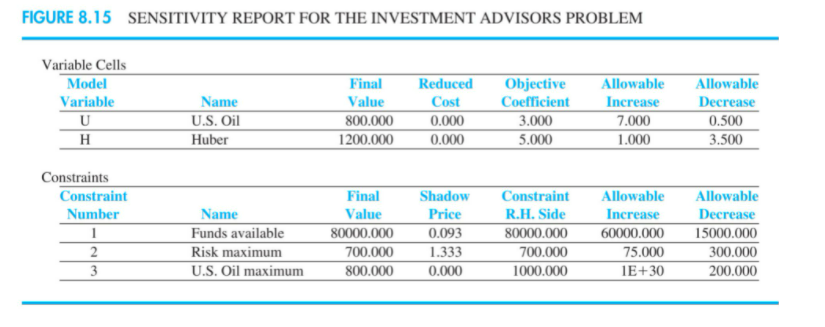

7. Investment Advisors, Inc., is a brokerage firm that manages stock portfolios for a num- ber of clients. A particular portfolio consists of U shares of U.S. Oil and H shares of Huber Steel. The annual return for U.S. Oil is $3 per share and the annual return for Huber Steel is $5 per share. U.S. Oil sells for $25 per share and Huber Steel sells for $50 per share. The portfolio has $80,000 to be invested. The portfolio risk index (0.50 per share of U.S. Oil and 0.25 per share for Huber Steel) has a maximum of 700. In addition, the portfolio is limited to a maximum of 1000 shares of U.S. Oil. The linear programming formulation that will maximize the total annual return of the portfolio is as follows: 1U Max 3U + 5H Maximize total annual return s.t. 250 + 50H = 80,000 Funds available 0.50U + 0.25H 700 Risk maximumStep by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock