Question: Please show method/process/calculation as applicable. Thanks Question 10 4 pts Jimmy is analyzing the estimated net present value of a project under various future conditions.

Please show method/process/calculation as applicable. Thanks

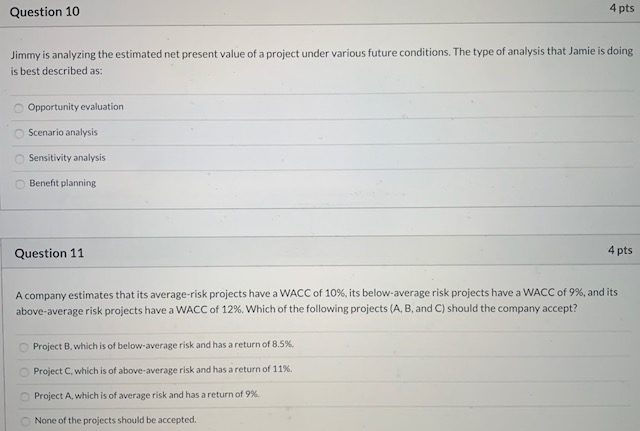

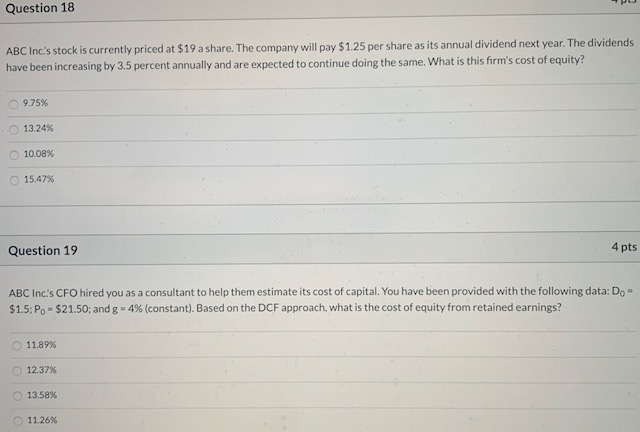

Question 10 4 pts Jimmy is analyzing the estimated net present value of a project under various future conditions. The type of analysis that Jamie is doing is best described as: Opportunity evaluation Scenario analysis Sensitivity analysis Benefit planning Question 11 4 pts A company estimates that its average-risk projects have a WACC of 10%, its below-average risk projects have a WACC of 9%, and its above average risk projects have a WACC of 12%. Which of the following projects (A, B, and C) should the company accept? Project B, which is of below average risk and has a return of 8.5%. Project C, which is of above average risk and has a return of 11% Project A which is of average risk and has a return of 9% None of the projects should be accepted. Question 18 ABC Inc's stock is currently priced at $19 a share. The company will pay $1.25 per share as its annual dividend next year. The dividends have been increasing by 3.5 percent annually and are expected to continue doing the same. What is this firm's cost of equity 9.75% 13.24% 10.08% 15.47% Question 19 4 pts ABC Inc.'s CFO hired you as a consultant to help them estimate its cost of capital. You have been provided with the following data: Do - $1.5: Po - $21.50; and g -4% (constant). Based on the DCF approach, what is the cost of equity from retained earnings? 11.89% 12.37% 13.58% 11.26%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts