Question: please show process The fallowing infarmation is trom Eown inc. for a longgterm construction project that is expected to be completed in jamuary of next

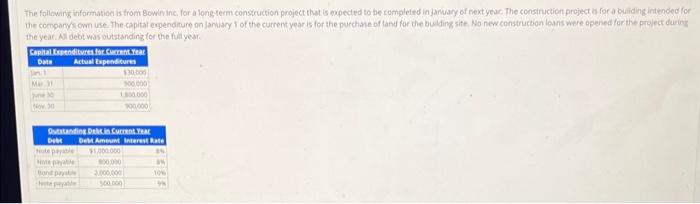

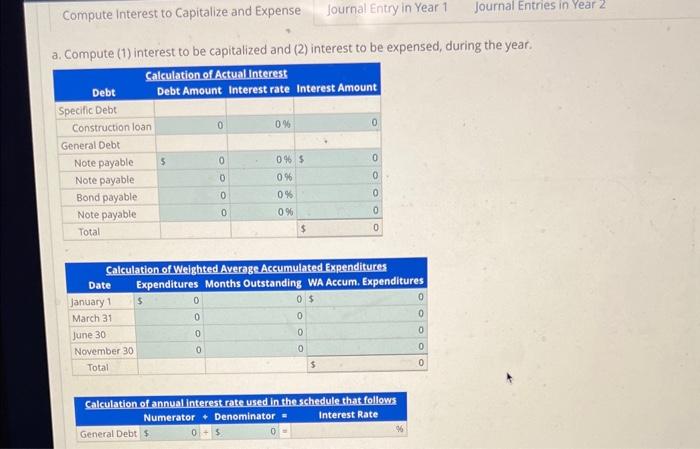

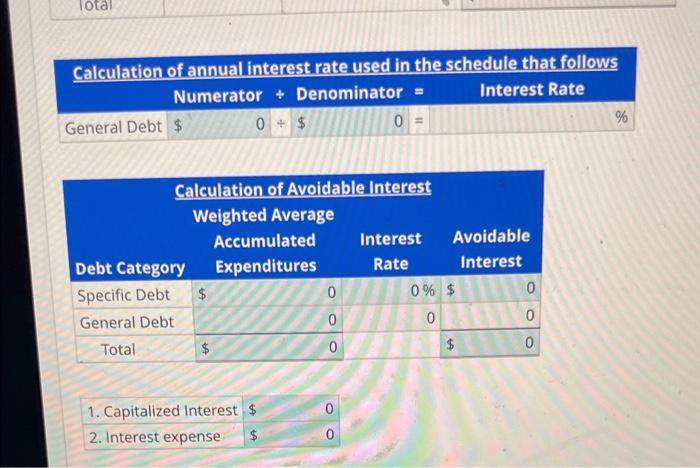

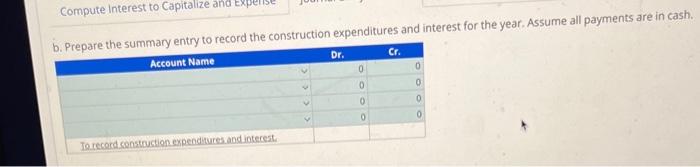

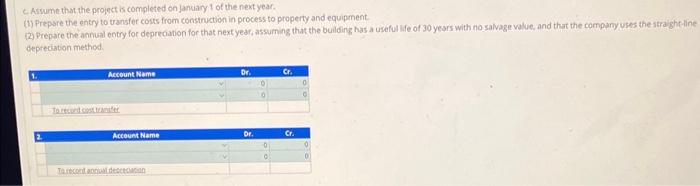

The fallowing infarmation is trom Eown inc. for a longgterm construction project that is expected to be completed in jamuary of next year. The consiruction project a for a building intended for the comparysi own use. The capital egpendimure on Janwary 1 of the currentyear is for the purchane of land for the bulding site Mo new construcbion loans were opened for the project daring the yeat. Al debt was outstanding for the full year. Compute Interest to Capitalize and Expense Journal Entry in Year 1 Journal Entr a. Compute (1) interest to be capitalized and (2) interest to be expensed, during the year. Calculation of annual interest rate used in the schedule that follows Calculation of Avoidable Interest Weighted Average Accumulated Interest Avoidable \begin{tabular}{|c|c|c|} \hline Debt Category & \multicolumn{2}{c|}{ Expenditures } \\ \hline Specific Debt & $ & 0 \\ \hline General Debt & & 0 \\ \hline Total & $ & 0 \\ \hline \end{tabular} Rate Interest \begin{tabular}{c|cc|} \hline 0% & $ & 0 \\ \hline 0 & 0 \\ \hline & $ & 0 \\ \hline \end{tabular} 1. Capitalized Interest $ 2. Interest expense 0 Compute Interest to L. n.ansi the cummarv entry to record the construction expenditures and interest for the year. Assume all payments are in cash. C. Aswume that the project is completed on janciary 1 of the next year. (1) Prepsre the entry to transfer costs from construction in process to property and equipment. (2) Prepare the annual entry for deprecation for that next year; assuming that the building has a useful Ife of 30 years with no salvage walue, and that the company uses the atraigheline bepreciation method. The fallowing infarmation is trom Eown inc. for a longgterm construction project that is expected to be completed in jamuary of next year. The consiruction project a for a building intended for the comparysi own use. The capital egpendimure on Janwary 1 of the currentyear is for the purchane of land for the bulding site Mo new construcbion loans were opened for the project daring the yeat. Al debt was outstanding for the full year. Compute Interest to Capitalize and Expense Journal Entry in Year 1 Journal Entr a. Compute (1) interest to be capitalized and (2) interest to be expensed, during the year. Calculation of annual interest rate used in the schedule that follows Calculation of Avoidable Interest Weighted Average Accumulated Interest Avoidable \begin{tabular}{|c|c|c|} \hline Debt Category & \multicolumn{2}{c|}{ Expenditures } \\ \hline Specific Debt & $ & 0 \\ \hline General Debt & & 0 \\ \hline Total & $ & 0 \\ \hline \end{tabular} Rate Interest \begin{tabular}{c|cc|} \hline 0% & $ & 0 \\ \hline 0 & 0 \\ \hline & $ & 0 \\ \hline \end{tabular} 1. Capitalized Interest $ 2. Interest expense 0 Compute Interest to L. n.ansi the cummarv entry to record the construction expenditures and interest for the year. Assume all payments are in cash. C. Aswume that the project is completed on janciary 1 of the next year. (1) Prepsre the entry to transfer costs from construction in process to property and equipment. (2) Prepare the annual entry for deprecation for that next year; assuming that the building has a useful Ife of 30 years with no salvage walue, and that the company uses the atraigheline bepreciation method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts