Question: Please show solutions using Excel. If possible please include the excel spreadsheet link or screenshots. Thank you! If the cost of capital is 12%, which

Please show solutions using Excel. If possible please include the excel spreadsheet link or screenshots. Thank you!

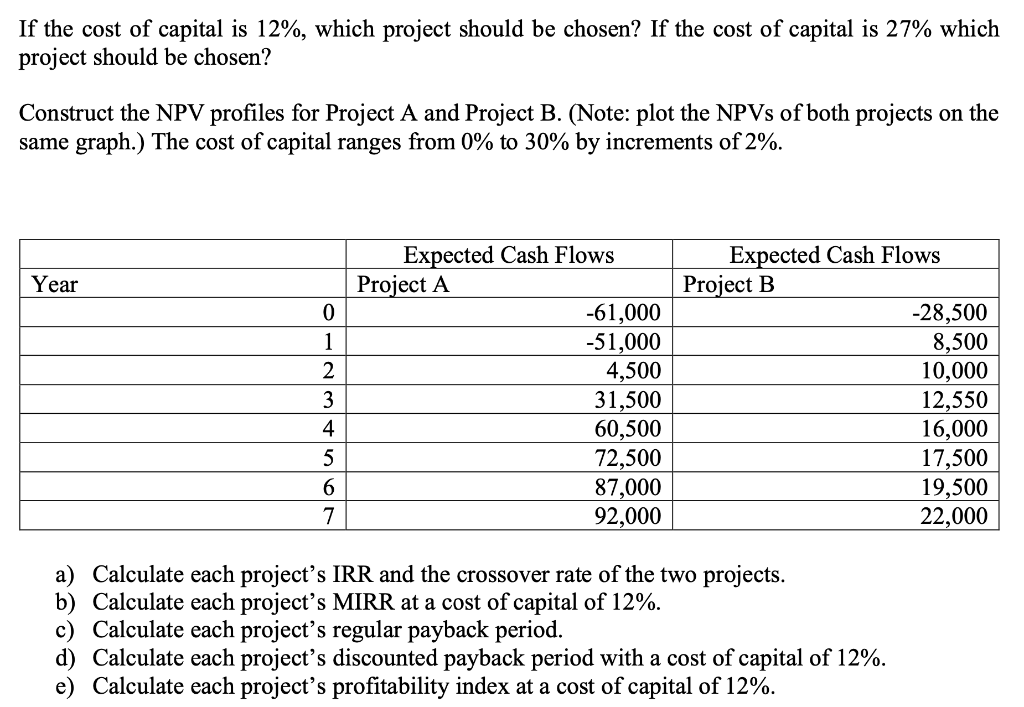

If the cost of capital is 12%, which project should be chosen? If the cost of capital is 27% which project should be chosen? Construct the NPV profiles for Project A and Project B. (Note: plot the NPVs of both projects on the same graph.) The cost of capital ranges from 0% to 30% by increments of 2%. Year 0 1 2 3 4 5 6 7 Expected Cash Flows Project A -61,000 -51,000 4,500 31,500 60,500 72,500 87,000 92,000 Expected Cash Flows Project B -28,500 8,500 10,000 12,550 16,000 17,500 19,500 22,000 a) Calculate each project's IRR and the crossover rate of the two projects. b) Calculate each project's MIRR at a cost of capital of 12%. c) Calculate each project's regular payback period. d) Calculate each project's discounted payback period with a cost of capital of 12%. e) Calculate each project's profitability index at a cost of capital of 12%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts