Question: please show step by step and where you got the info please no excel Section: Name: Q5. Project Cost of Capital (25 points) SAIPA Corp.

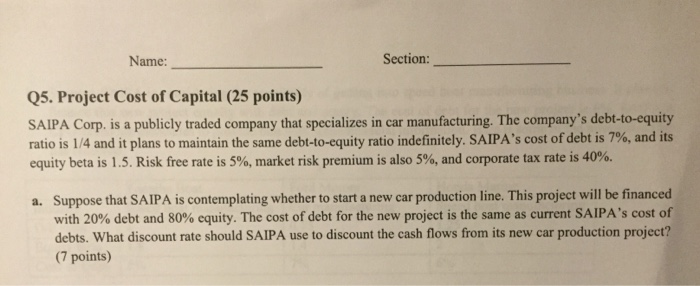

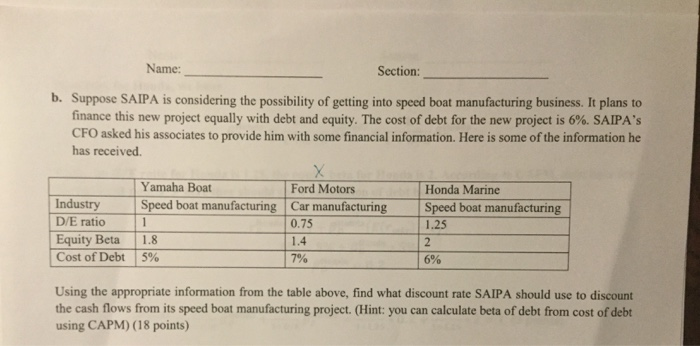

Section: Name: Q5. Project Cost of Capital (25 points) SAIPA Corp. is a publicly traded company that specializes in car manufacturing. The company's debt-to-equity ratio is 1/4 and it plans to maintain the same debt-to-equity ratio indefinitely. SAIPA's cost of debt is 7%, and its equity beta is 1.5. Risk free rate is 5%, market risk premium is also 5 % , and corporate tax rate is 40% Suppose that SAIPA is contemplating whether to starta new car production line. This project will be financed with 20% debt and 80% equity. The cost of debt for the new project is the same as current SAIPA's cost of debts. What discount rate should SAIPA use to discount the cash flows from its new car production project? a. (7 points) Name: Section: b. Suppose SAIPA is considering the possibility of getting into speed boat manufacturing business. It plans to finance this new project equally with debt and equity. The cost of debt for the new project is 6 %. SAIPA's CFO asked his associates to provide him with some financial information. Here is some of the information he has received. X Ford Motors Car manufacturing 0.75 Yamaha Boat Honda Marine Industry D/E ratio Speed boat manufacturing Speed boat manufacturing 1.25 Equity Beta Cost of Debt 5% 1.8 1.4 2 7% 6% Using the appropriate inforrmation from the table above, find what discount rate SAIPA should use to discount the cash flows from its speed boat manufacturing project. (Hint: you can calculate beta of debt from cost of debt using CAPM) (18 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts