Question: Please show step by step calculations. Answer the question on the space provided below. Show work for partial credit. The more organized and neat your

Please show step by step calculations.

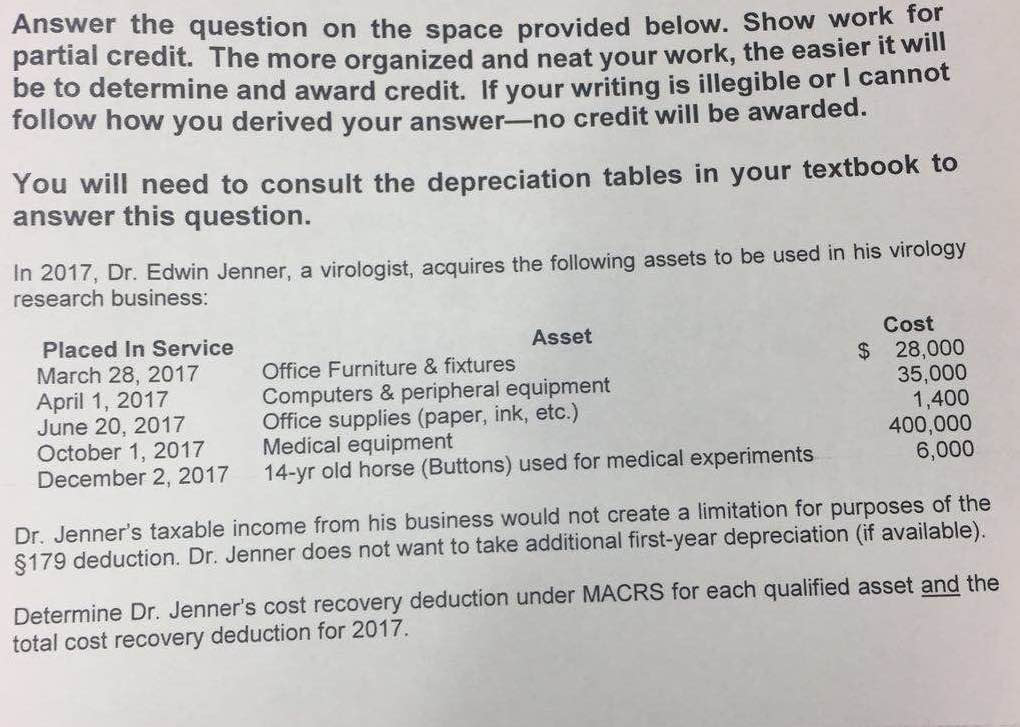

Answer the question on the space provided below. Show work for partial credit. The more organized and neat your work, the easier it wi be to determine and award credit. If your writing is illegible or I cannot follow how you derived your answer--no credit will be awarded. You will need to consult the depreciation tables in your tex answer this question. tbook to In 201 research business: Dr. Edwin Jenner, a virologist, acquires the following assets to be used in his virology Placed In Service March 28, 2017 April 1, 2017 June 20, 2017 October 1, 2017 December 2, 2017 Asset Cost Office Furniture & fixtures Computers & peripheral equipment Office supplies (paper, ink, etc.) Medical equipment 14-yr old horse (Buttons) used for medical experiments 28,000 35,000 1,400 400,000 6,000 Dr. Jenner's taxable income from his business would not create a limitation for purposes of the $179 deduction. Dr. Jenner does not want to take additional first-year depreciation (if available). Determine Dr. Jenner's cost recovery deduction under MACRS for each qualified asset and the total cost recovery deduction for 2017

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts