Question: Answer the question on the space below. Show work for partial credit. The more organized and neat your work, the easier it will be to

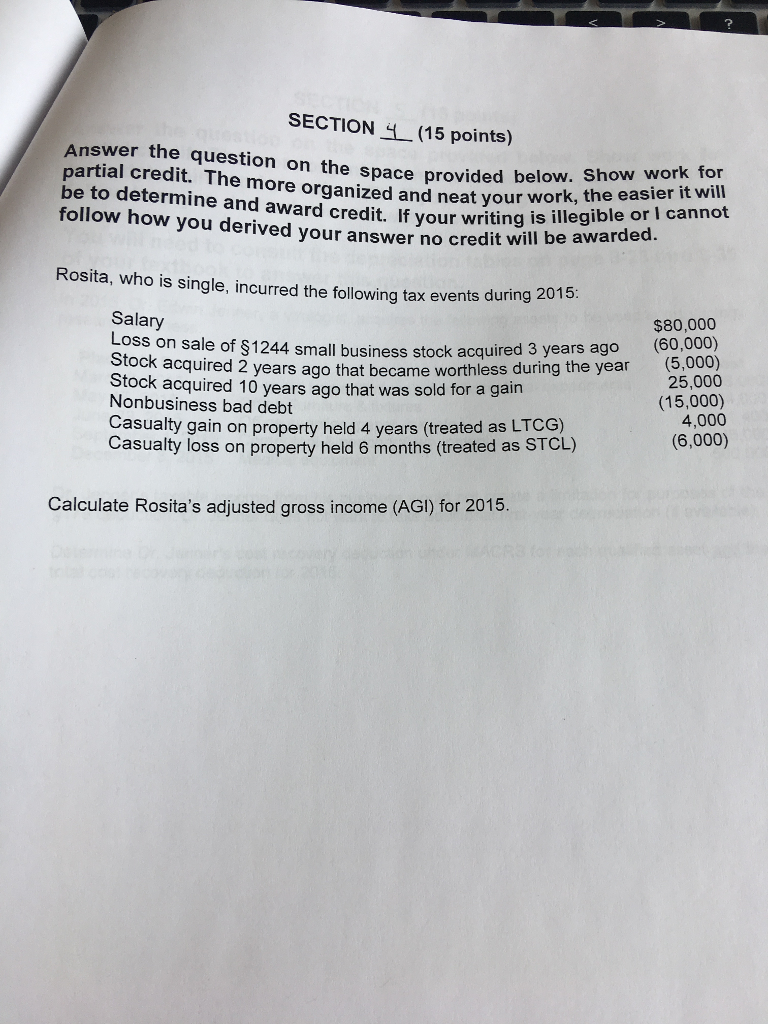

Answer the question on the space below. Show work for partial credit. The more organized and neat your work, the easier it will be to determine and award credit. If you writing is illegible or I cannot follow how you derived your answer no credit will be awarded. Rosita, who is single, incurred the following tax events during 2015: Salary $80,000 Loss on sale of 1244 small business stock acquired 3 years ago (60,000) Stock acquired 2 years ago that become worthless during the year (5,000) Stock acquired 10 years ago that sold gain 25,000 Nonbusiness bad debt (15,000) Casualty gain on property held 4 years (treated as LTCG) (4,000) Casualty loss on property held 6 months (treated as STCL) (6,000) Calculate Rosita's adjusted gross income (AGI) for 2015

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts