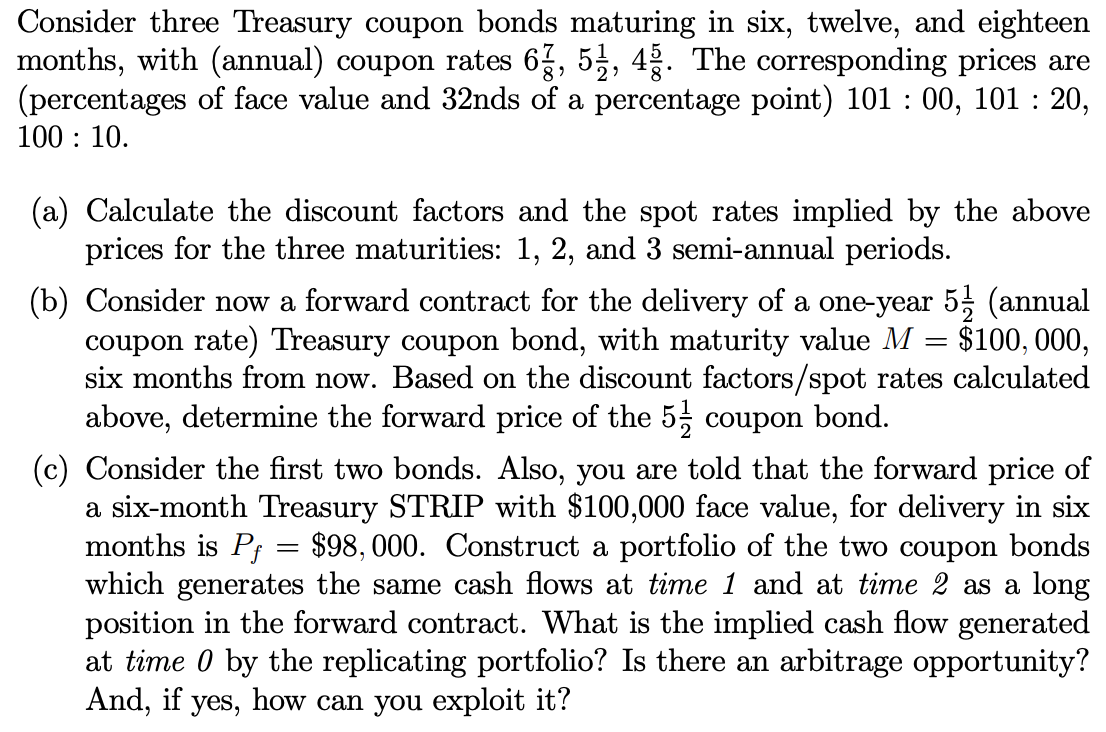

Question: Please show step by step Consider three Treasury coupon bonds maturing in six, twelve, and eighteen months, with (annual) coupon rates 62, 57, 49. The

Please show step by step

Please show step by step

Consider three Treasury coupon bonds maturing in six, twelve, and eighteen months, with (annual) coupon rates 62, 57, 49. The corresponding prices are (percentages of face value and 32nds of a percentage point) 101 : 00, 101 : 20, 100 : 10. (a) Calculate the discount factors and the spot rates implied by the above prices for the three maturities: 1, 2, and 3 semi-annual periods. (b) Consider now a forward contract for the delivery of a one-year 57 (annual coupon rate) Treasury coupon bond, with maturity value M = $100,000, six months from now. Based on the discount factors/spot rates calculated above, determine the forward price of the 5 coupon bond. (c) Consider the first two bonds. Also, you are told that the forward price of a six-month Treasury STRIP with $100,000 face value, for delivery in six months is Pf = $98,000. Construct a portfolio of the two coupon bonds which generates the same cash flows at time 1 and at time 2 as a long position in the forward contract. What is the implied cash flow generated at time 0 by the replicating portfolio? Is there an arbitrage opportunity? And, if yes, how can you exploit it

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts