Question: Please show step by step instructions and formulas 36. The payback of a project is the number of years it takes before the project's total

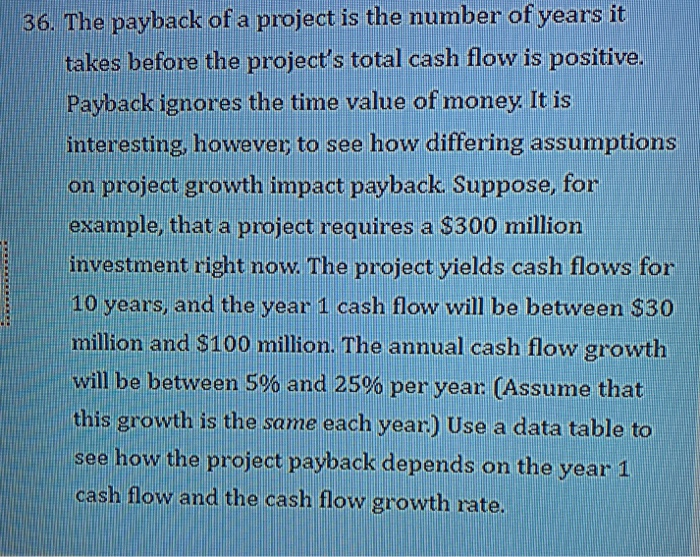

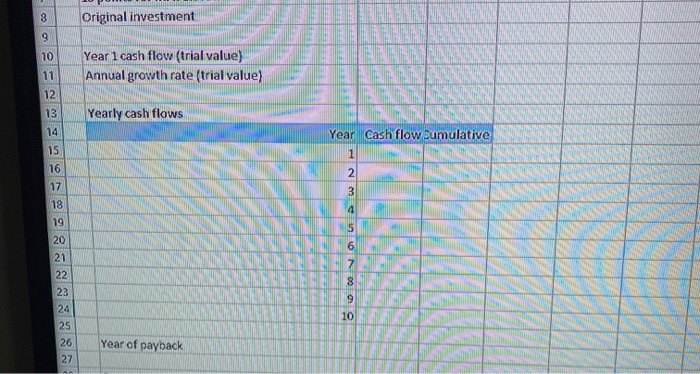

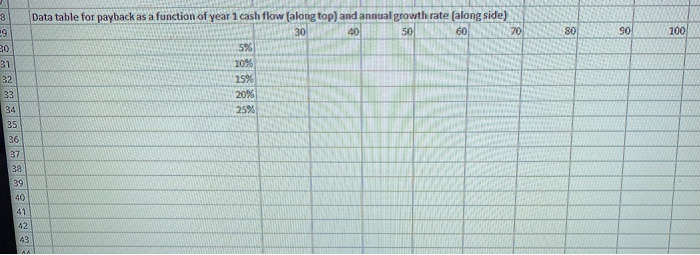

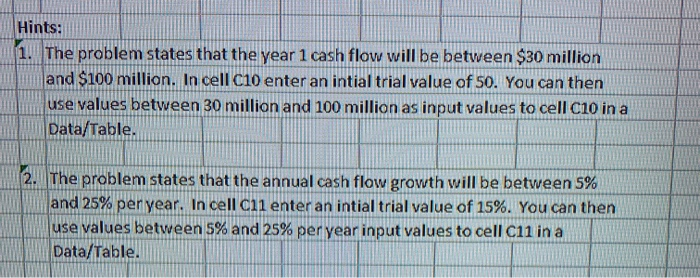

36. The payback of a project is the number of years it takes before the project's total cash flow is positive. Payback ignores the time value of money. It is interesting, however, to see how differing assumptions on project growth impact payback. Suppose, for example, that a project requires a $300 million investment right now. The project yields cash flows for 10 years, and the year 1 cash flow will be between $30 million and $100 million. The annual cash flow growth will be between 5% and 25% per year. (Assume that this growth is the same each year.) Use a data table to see how the project payback depends on the year 1 cash flow and the cash flow growth rate. Original investment 8 9 10 Year 1 cash flow (trial value) Annual growth rate (trial value) 11 12 13 Yearly cash flows Year Cash flow bumulative 1 14 15 16 17 18 19 2 3 4 6 7 8 20 21 22 23 24 25 26 27 000 9 10 Year of payback co 40 80 90 100 -9 30 31 32 33 Data table for payback as a function of year 1 cash flow (along top) and annual growth rate (along side) 30 50 60 70 5% 10% 259 20% 25% 34 35 36 37 38 39 40 41 42 Hints: 1. The problem states that the year 1 cash flow will be between $30 million and $100 million. In cell C10 enter an intial trial value of 50. You can then use values between 30 million and 100 million as input values to cell clo in a Data/Table. 2. The problem states that the annual cash flow growth will be between 5% and 25% per year. In cell C11 enter an intial trial value of 15%. You can then use values between 5% and 25% per year input values to cell C11 in a Data/Table

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts