Question: Please show step by step! Norwich Tool, a large machine shop, is considering replacing one of its lathes with either of two new lathes lathe

Please show step by step!

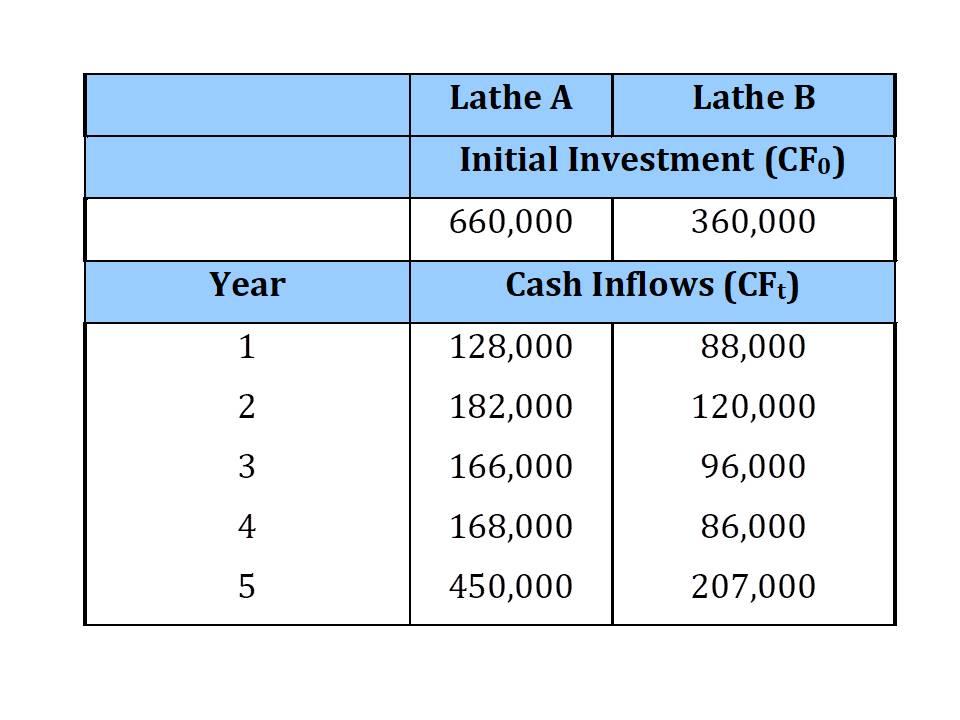

Norwich Tool, a large machine shop, is considering replacing one of its lathes with either of two new lathes lathe A or lathe B. Lathe A is a highly automated, computer- controlled lathe; lathe B is a less expensive lathe that uses standard technology. To analyze these alternatives, Mario Jackson, a financial analyst, prepared estimates of the initial investment and incremental (relevant) cash inflows associated with each lathe. These are shown in the following table.

Note that Mario plans to analyze both lathes over a 5-year period. At the end of that time, the lathes would be sold, thus accounting for the large fifth-year cash inflows. Mario believes that the two lathes are equally risky and that the acceptance of either of them will not change the firms overall risk. He therefore decides to apply the firms 13% cost of capital when analyzing the lathes. Norwich Tool requires all projects to have a maximum payback period of 4.0 years.

To Do:

1. Assuming equal risk, use the following sophisticated capital budgeting techniques to assess the acceptability and relative ranking of each lathe: a. Net present value (NPV). b. Internal rate of return (IRR).

2. Summarize the preferences indicated by the techniques used in parts 1 and 2. Do the projects have conflicting rankings?

3. Draw the net present value profiles for both projects on the same set of axes, and discuss any conflict in rankings that may exist between NPV and IRR. Explain any observed conflict in terms of the relative differences in the magnitude and timing of each projects cash flows.

4. Use your findings in parts a through d to indicate, on both (1) a theoretical basis and (2) a practical basis, which lathe would be preferred. Explain any difference in recommendations.

Lathe A Lathe B Initial Investment (CF) 660,000 360,000 Year Cash Inflows (CFt) 1 128,000 88,000 2 182,000 3 166,000 120,000 96,000 86,000 207,000 4 168,000 5 450,000Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts