Question: Please show step by step solution (c) Describe the distinetions between GAAP and IFRS. (a) Discuss the factors to be considered in computing depreciation. (b)

Please show step by step solution

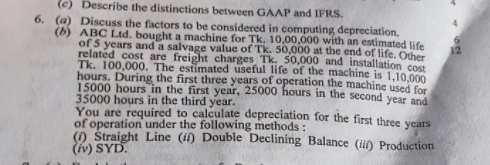

(c) Describe the distinetions between GAAP and IFRS. (a) Discuss the factors to be considered in computing depreciation. (b) ABC Ltd. bought a machine for Tk. 10,00,000 with an estimated life of 5 years and a salvage value of Tk. 50,000 at the end of life. Other related cost are freight charges "Tk. 50,000 and installation cost Tk. 100,000 . The estimated useful life of the machine is 1,10,000 hours. During the first three years of operation the machine used for 15000 hours in the first year, 25000 hours in the second year and 35000 hours in the third year. You are required to calculate depreciation for the first three years of operation under the following methods: (i) Straight Line (ii) Double Declining Balance (iii) Production (iv) SYD

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts