Question: Please show step how to do it in Excel thanks UC=Unit Cost VC=Variable Cost COS=Cost of sales BEP=Break even point P = price per unit

Please show step how to do it in Excel thanks

UC=Unit Cost

VC=Variable Cost

COS=Cost of sales

BEP=Break even point

P = price per unit (after all discounts)

V = variable (unit cost)

Wt=%of sales

TR = total revenue

Rev=Revenue

Variable costs = Cost of Sales (COS)

Cost of Sales (COS) = Sales (units sold) * UC

Revenue = Sales (units sold) * SP

Where SP = Selling Price

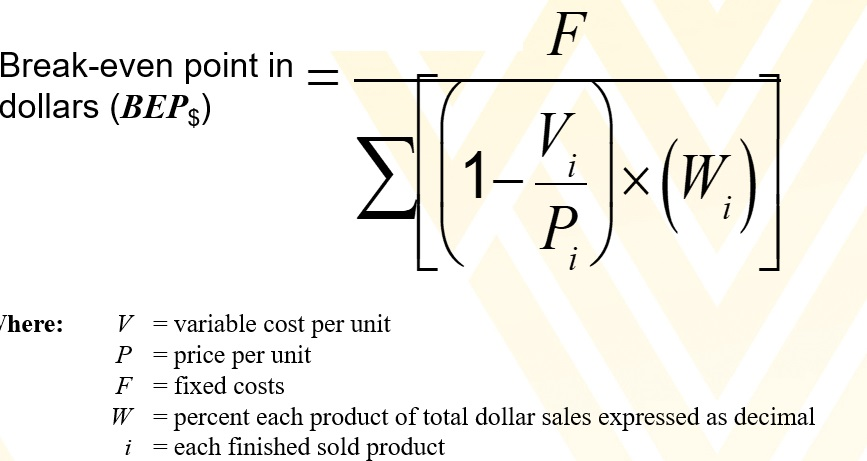

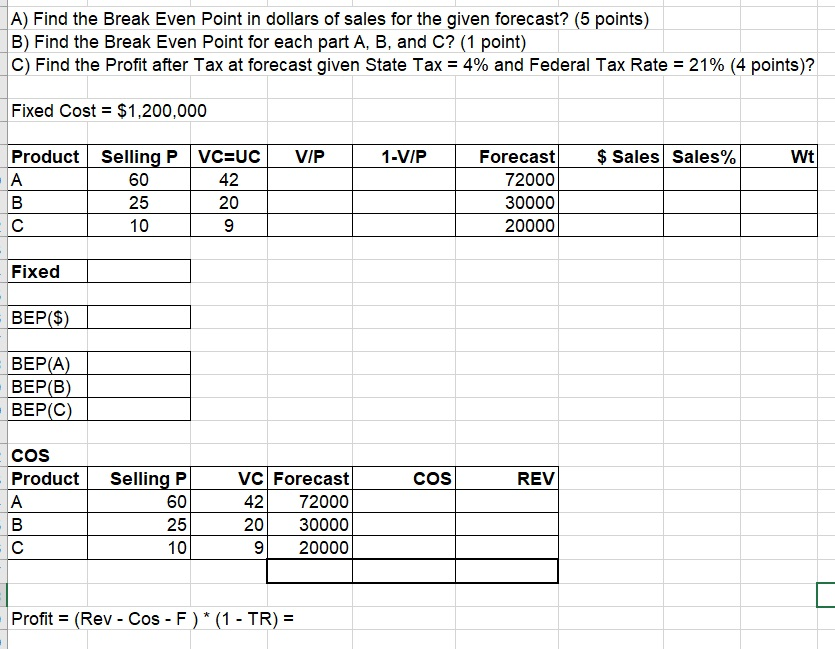

Break-even point in - - dollars (BEPG) [*). here: V = variable cost per unit P = price per unit F = fixed costs W = percent each product of total dollar sales expressed as decimal i = each finished sold product A) Find the Break Even Point in dollars of sales for the given forecast? (5 points) B) Find the Break Even Point for each part A, B, and C? (1 point) C) Find the Profit after Tax at forecast given State Tax = 4% and Federal Tax Rate = 21% (4 points)? Fixed Cost = $1,200,000 VIP 1-V/P $ Sales Sales% A Product L B C Selling P 60 25 10 VC=UC 42 / 20 9 Forecast 72000 30000 20000 - Fixed - BEP($). - - BEPA) BEP(B) BEP(C) COS - Product cos REV Selling P 60 25 10 V C Forecast 42 72000 20 30000 9 20000 - Profit = (Rev - Cos - F)* (1 - TR) = Break-even point in - - dollars (BEPG) [*). here: V = variable cost per unit P = price per unit F = fixed costs W = percent each product of total dollar sales expressed as decimal i = each finished sold product A) Find the Break Even Point in dollars of sales for the given forecast? (5 points) B) Find the Break Even Point for each part A, B, and C? (1 point) C) Find the Profit after Tax at forecast given State Tax = 4% and Federal Tax Rate = 21% (4 points)? Fixed Cost = $1,200,000 VIP 1-V/P $ Sales Sales% A Product L B C Selling P 60 25 10 VC=UC 42 / 20 9 Forecast 72000 30000 20000 - Fixed - BEP($). - - BEPA) BEP(B) BEP(C) COS - Product cos REV Selling P 60 25 10 V C Forecast 42 72000 20 30000 9 20000 - Profit = (Rev - Cos - F)* (1 - TR) =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts