Question: please show step-by-step no excel 2. CAPM (15 points + one point extra credit) Consider a world with only two risky assets, A and B,

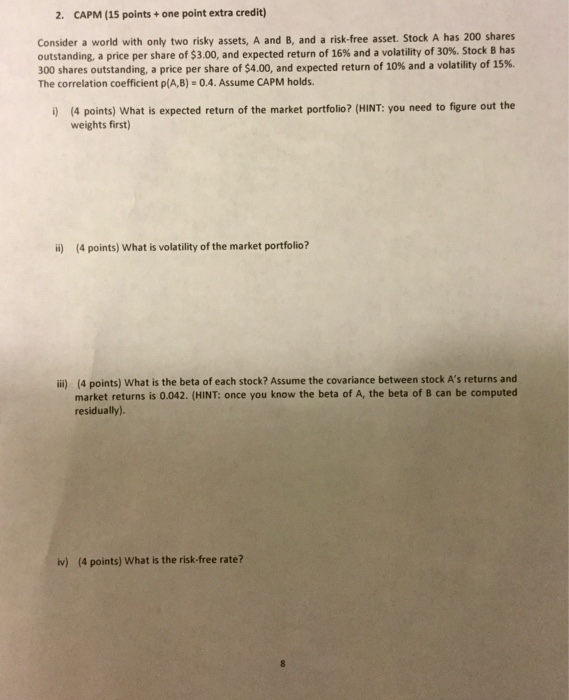

2. CAPM (15 points + one point extra credit) Consider a world with only two risky assets, A and B, and a risk-free asset. Stock A has 200 shares outstanding, a price per share of $3.00, and expected return of 16% and a volatility of 30%. Stock B has 300 shares outstanding, a price per share of $4.00, and expected return of 10% and a volatility of 15% The correlation coefficient p(A,B) - 0.4. Assume CAPM holds. 0 (4 points) What is expected return of the market portfolio? (HINT: you need to figure out the weights first) ii) (4 points) What is volatility of the market portfolio? m) (4 points) What is the beta of each stock? Assume the covariance between stock A's returns and market returns is 0.042. (HINT: once you know the beta of A, the beta or can be computed residually) iv) (4 points) What is the risk-free rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts