Question: Please show step-by-step solution. If using excel, please show formulas. Please note that the U = 12. 18. A pension fund currently makes payouts to

Please show step-by-step solution. If using excel, please show formulas. Please note that the "U" = 12.

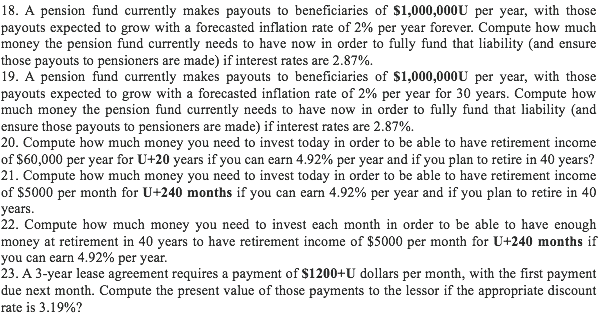

18. A pension fund currently makes payouts to beneficiaries of $1,000,0000 per year, with those payouts expected to grow with a forecasted inflation rate of 2% per year forever. Compute how much money the pension fund currently needs to have now in order to fully fund that liability and ensure those payouts to pensioners are made) if interest rates are 2.87%. 19. A pension fund currently makes payouts to beneficiaries of $1,000,0000 per year, with those payouts expected to grow with a forecasted inflation rate of 2% per year for 30 years. Compute how much money the pension fund currently needs to have now in order to fully fund that liability (and ensure those payouts to pensioners are made) if interest rates are 2.87% 20. Compute how much money you need to invest today in order to be able to have retirement income of $60,000 per year for U+20 years if you can earn 4.92% per year and if you plan to retire in 40 years? 21. Compute how much money you need to invest today in order to be able to have retirement income of $5000 per month for U+240 months if you can earn 4.92% per year and if you plan to retire in 40 years. 22. Compute how much money you need to invest each month in order to be able to have enough money at retirement in 40 years to have retirement income of $5000 per month for U+240 months if you can earn 4.92% per year. 23. A 3-year lease agreement requires a payment of $1200+U dollars per month, with the first payment due next month. Compute the present value of those payments to the lessor if the appropriate discount rate is 3.19%? 18. A pension fund currently makes payouts to beneficiaries of $1,000,0000 per year, with those payouts expected to grow with a forecasted inflation rate of 2% per year forever. Compute how much money the pension fund currently needs to have now in order to fully fund that liability and ensure those payouts to pensioners are made) if interest rates are 2.87%. 19. A pension fund currently makes payouts to beneficiaries of $1,000,0000 per year, with those payouts expected to grow with a forecasted inflation rate of 2% per year for 30 years. Compute how much money the pension fund currently needs to have now in order to fully fund that liability (and ensure those payouts to pensioners are made) if interest rates are 2.87% 20. Compute how much money you need to invest today in order to be able to have retirement income of $60,000 per year for U+20 years if you can earn 4.92% per year and if you plan to retire in 40 years? 21. Compute how much money you need to invest today in order to be able to have retirement income of $5000 per month for U+240 months if you can earn 4.92% per year and if you plan to retire in 40 years. 22. Compute how much money you need to invest each month in order to be able to have enough money at retirement in 40 years to have retirement income of $5000 per month for U+240 months if you can earn 4.92% per year. 23. A 3-year lease agreement requires a payment of $1200+U dollars per month, with the first payment due next month. Compute the present value of those payments to the lessor if the appropriate discount rate is 3.19%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts