Question: Please show steps 5. Given the ABS & ABS CDO shown below, what is the minimum loss on the portfolio of underlying assets when: ABS

Please show steps

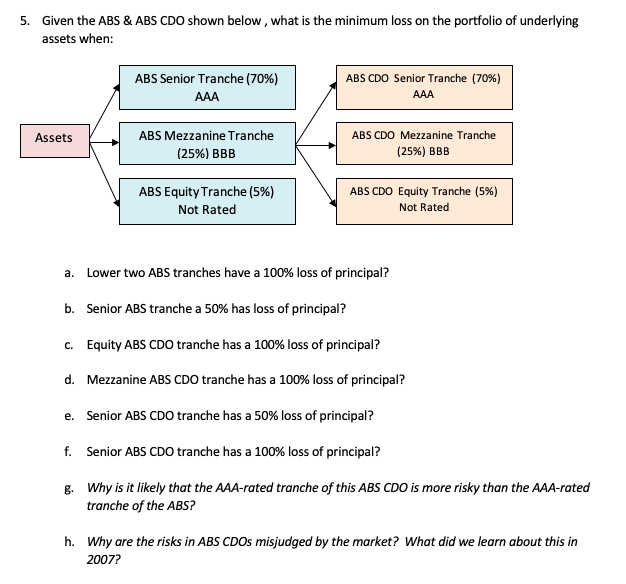

5. Given the ABS & ABS CDO shown below, what is the minimum loss on the portfolio of underlying assets when: ABS Senior Tranche (70%) AAA ABS CDO Senior Tranche (70%) AAA Assets ABS Mezzanine Tranche (25%) BBB ABS CDO Mezzanine Tranche (25%) BBB ABS Equity Tranche (5%) Not Rated ABS CDO Equity Tranche (5%) Not Rated a. Lower two ABS tranches have a 100% loss of principal? b. Senior ABS tranche a 50% has loss of principal? c. Equity ABS CDO tranche has a 100% loss of principal? d. Mezzanine ABS CDO tranche has a 100% loss of principal? e. Senior ABS CDO tranche has a 50% loss of principal? f. Senior ABS CDO tranche has a 100% loss of principal? g. Why is it likely that the AAA-rated tranche of this ABS CDO is more risky than the AAA-rated tranche of the ABS? h. Why are the risks in ABS CDOs misjudged by the market? What did we learn about this in 2007? 5. Given the ABS & ABS CDO shown below, what is the minimum loss on the portfolio of underlying assets when: ABS Senior Tranche (70%) AAA ABS CDO Senior Tranche (70%) AAA Assets ABS Mezzanine Tranche (25%) BBB ABS CDO Mezzanine Tranche (25%) BBB ABS Equity Tranche (5%) Not Rated ABS CDO Equity Tranche (5%) Not Rated a. Lower two ABS tranches have a 100% loss of principal? b. Senior ABS tranche a 50% has loss of principal? c. Equity ABS CDO tranche has a 100% loss of principal? d. Mezzanine ABS CDO tranche has a 100% loss of principal? e. Senior ABS CDO tranche has a 50% loss of principal? f. Senior ABS CDO tranche has a 100% loss of principal? g. Why is it likely that the AAA-rated tranche of this ABS CDO is more risky than the AAA-rated tranche of the ABS? h. Why are the risks in ABS CDOs misjudged by the market? What did we learn about this in 2007

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts