Question: **PLEASE SHOW STEPS AND CALCULATIONS FROM BEGINNING TO END** Flat Iron Corporation, a lessor, entered into a lease agreement on November 1, 20X1. The lease

**PLEASE SHOW STEPS AND CALCULATIONS FROM BEGINNING TO END**

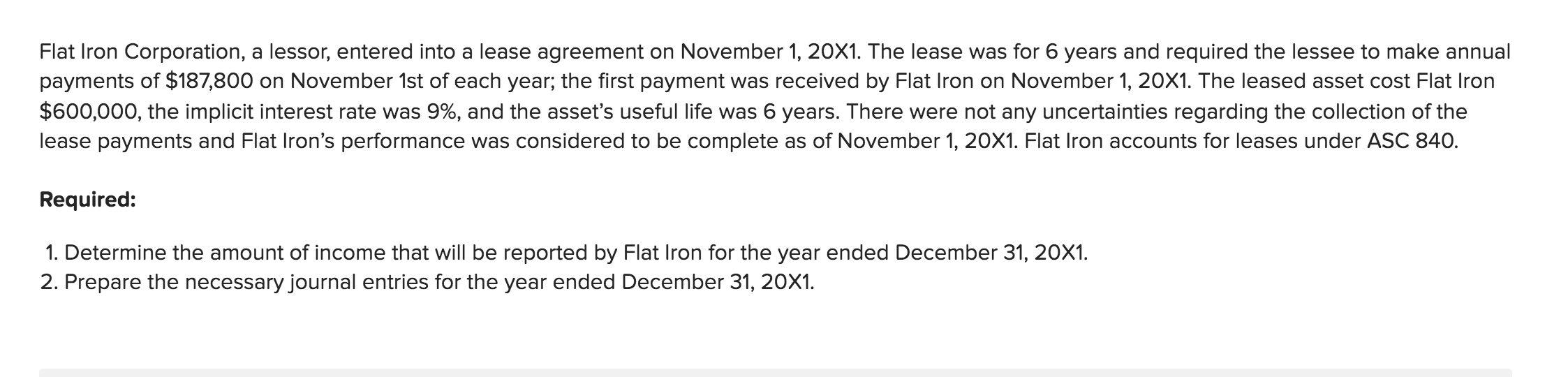

Flat Iron Corporation, a lessor, entered into a lease agreement on November 1, 20X1. The lease was for 6 years and required the lessee to make annual payments of $187,800 on November 1st of each year, the first payment was received by Flat Iron on November 1, 20X1. The leased asset cost Flat Iron $600,000, the implicit interest rate was 9%, and the asset's useful life was 6 years. There were not any uncertainties regarding the collection of the lease payments and Flat Iron's performance was considered to be complete as of November 1, 20X1. Flat Iron accounts for leases under ASC 840. Required: 1. Determine the amount of income that will be reported by Flat Iron for the year ended December 31, 20X1. 2. Prepare the necessary journal entries for the year ended December 31, 20X1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts