Question: Please show steps and calculations so that I can comprehend. Thank you in advance. 1. Boeing just signed a contract to sell a Boeing 737

Please show steps and calculations so that I can comprehend. Thank you in advance.

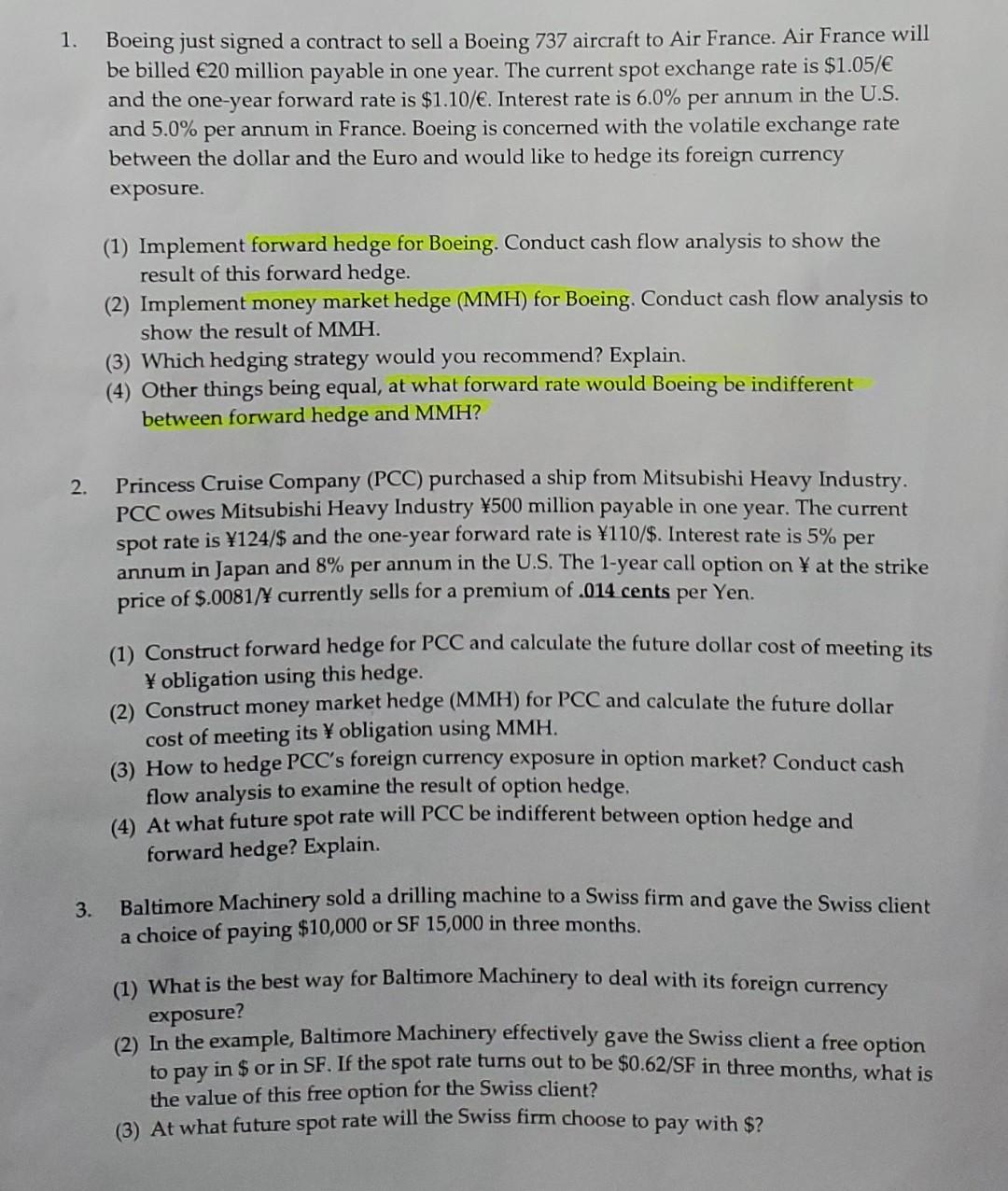

1. Boeing just signed a contract to sell a Boeing 737 aircraft to Air France. Air France will be billed 20 million payable in one year. The current spot exchange rate is $1.05/ and the one-year forward rate is $1.10/. Interest rate is 6.0% per annum in the U.S. and 5.0% per annum in France. Boeing is concerned with the volatile exchange rate between the dollar and the Euro and would like to hedge its foreign currency exposure. (1) Implement forward hedge for Boeing. Conduct cash flow analysis to show the result of this forward hedge. (2) Implement money market hedge ( MMH ) for Boeing. Conduct cash flow analysis to show the result of MMH. (3) Which hedging strategy would you recommend? Explain. (4) Other things being equal, at what forward rate would Boeing be indifferent between forward hedge and MMH? 2. Princess Cruise Company (PCC) purchased a ship from Mitsubishi Heavy Industry. PCC owes Mitsubishi Heavy Industry 500 million payable in one year. The current spot rate is 124/$ and the one-year forward rate is 110/$. Interest rate is 5% per annum in Japan and 8% per annum in the U.S. The 1-year call option on at the strike price of $.0081/ currently sells for a premium of .014 cents per Yen. (1) Construct forward hedge for PCC and calculate the future dollar cost of meeting its obligation using this hedge. (2) Construct money market hedge (MMH) for PCC and calculate the future dollar cost of meeting its obligation using MMH. (3) How to hedge PCC's foreign currency exposure in option market? Conduct cash flow analysis to examine the result of option hedge. (4) At what future spot rate will PCC be indifferent between option hedge and forward hedge? Explain. 3. Baltimore Machinery sold a drilling machine to a Swiss firm and gave the Swiss client a choice of paying $10,000 or SF 15,000 in three months. (1) What is the best way for Baltimore Machinery to deal with its foreign currency exposure? (2) In the example, Baltimore Machinery effectively gave the Swiss client a free option to pay in \$ or in SF. If the spot rate turns out to be \$0.62/SF in three months, what is the value of this free option for the Swiss client? (3) At what future spot rate will the Swiss firm choose to pay with $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts