Question: PLEASE SHOW STEPS HOW TO COMPUTE PAYOFF TABLE FOR STOCK PRICES 0, 80, 100, 120, 140 Suppose you are allowed to trade the following financial

PLEASE SHOW STEPS HOW TO COMPUTE PAYOFF TABLE FOR STOCK PRICES 0, 80, 100, 120, 140

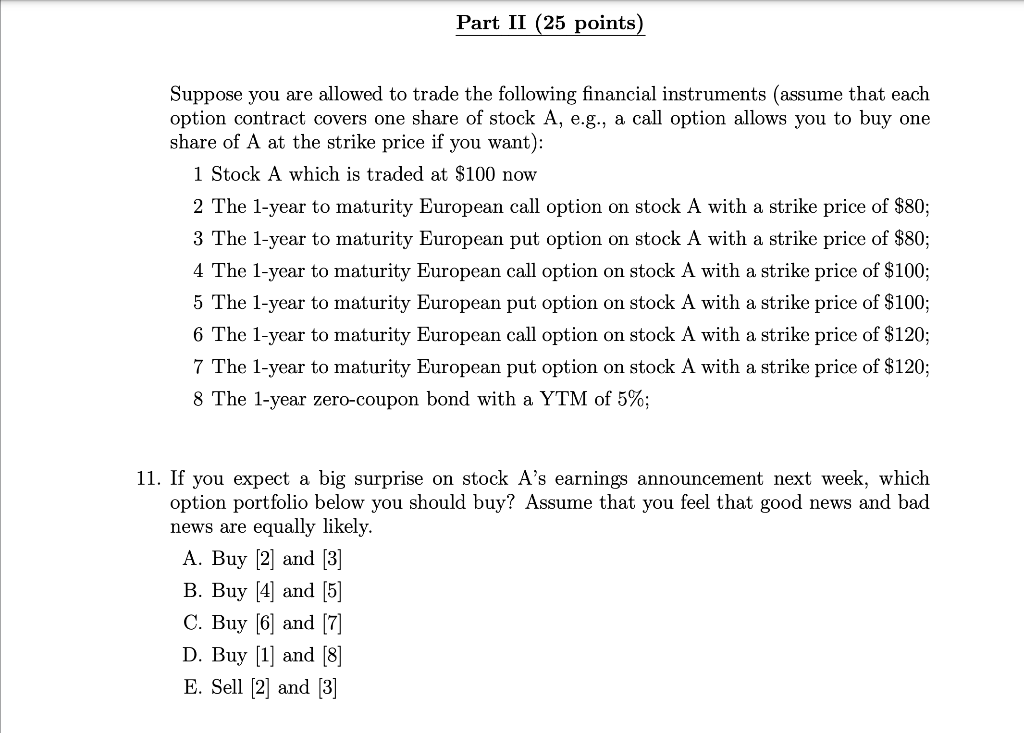

Suppose you are allowed to trade the following financial instruments (assume that each option contract covers one share of stock A, e.g., a call option allows you to buy one share of A at the strike price if you want): 1 Stock A which is traded at $100 now 2 The 1-year to maturity European call option on stock A with a strike price of $80; 3 The 1-year to maturity European put option on stock A with a strike price of $80; 4 The 1-year to maturity European call option on stock A with a strike price of $100; 5 The 1-year to maturity European put option on stock A with a strike price of $100; 6 The 1-year to maturity European call option on stock A with a strike price of $120; 7 The 1-year to maturity European put option on stock A with a strike price of $120; 8 The 1-year zero-coupon bond with a YTM of 5\%; 11. If you expect a big surprise on stock A's earnings announcement next week, which option portfolio below you should buy? Assume that you feel that good news and bad news are equally likely. A. Buy [2] and [3] B. Buy [4] and [5] C. Buy [6] and [7] D. Buy [1] and [8] E. Sell [2] and [3]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts