Question: PLEASE SHOW STEPS, I NEED IT FOR STUDYING On December 31, 2020, Pool Inc. purchased 90% of the outstanding common stock of Splash Company for

PLEASE SHOW STEPS, I NEED IT FOR STUDYING

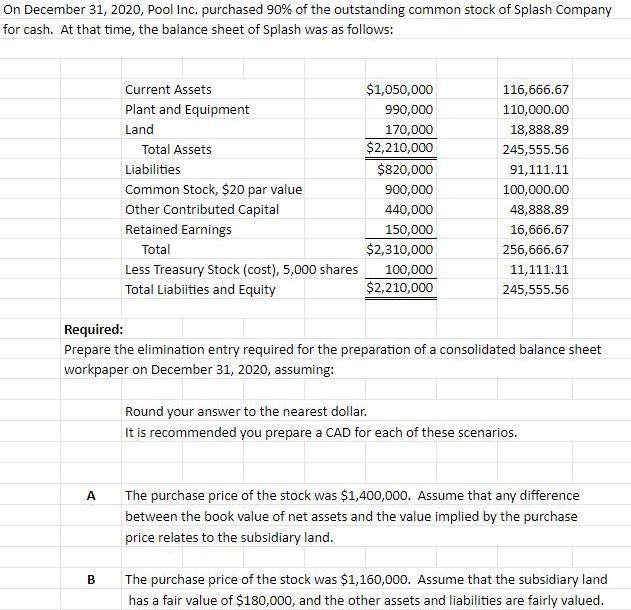

On December 31, 2020, Pool Inc. purchased 90% of the outstanding common stock of Splash Company for cash. At that time, the balance sheet of Splash was as follows: Current Assets $1,050,000 Plant and Equipment 990,000 Land 170,000 Total Assets $2,210,000 Liabilities $820,000 Common Stock, $20 par value 900,000 Other Contributed Capital 440,000 Retained Earnings 150,000 Total $2,310,000 Less Treasury Stock (cost), 5,000 shares 100,000 Total Liabiities and Equity $2,210,000 116,666.67 110,000.00 18,888.89 245,555.56 91,111.11 100,000.00 48,888.89 16,666.67 256,666.67 11,111.11 245,555.56 Required: Prepare the elimination entry required for the preparation of a consolidated balance sheet workpaper on December 31, 2020, assuming: Round your answer to the nearest dollar. It is recommended you prepare a CAD for each of these scenarios. A The purchase price of the stock was $1,400,000. Assume that any difference between the book value of net assets and the value implied by the purchase price relates to the subsidiary land. B The purchase price of the stock was $1,160,000. Assume that the subsidiary land has a fair value of $180,000, and the other assets and liabilities are fairly valued

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts