Question: please show steps on how you got the answers please ignore the original picture. please show steps by steps for this problem 2. Use the

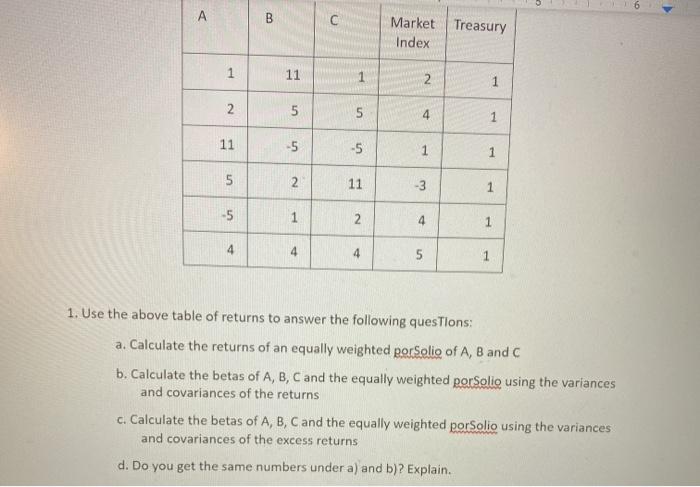

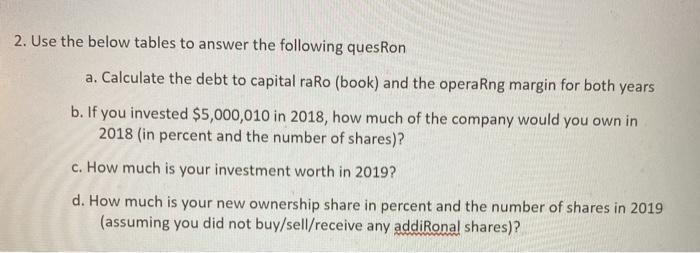

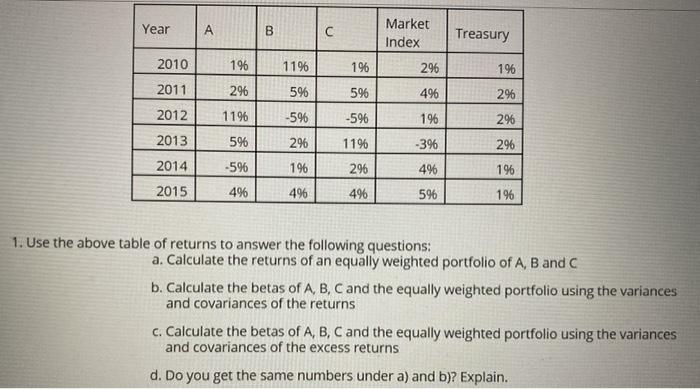

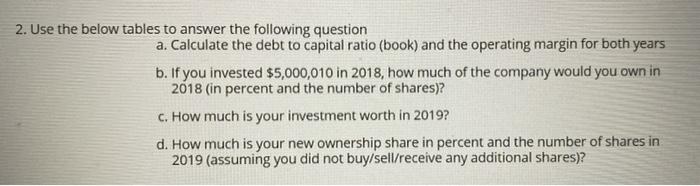

2. Use the below tables to answer the following quesRon a. Calculate the debt to capital raRo (book) and the operaRng margin for both years b. If you invested $5,000,010 in 2018, how much of the company would you own in 2018 (in percent and the number of shares)? c. How much is your investment worth in 2019? d. How much is your new ownership share in percent and the number of shares in 2019 (assuming you did not buy/sell/receive any addiRonal shares)? Year A Market Index Treasury 2010 196 1196 196 296 196 2011 296 5% 596 496 296 1196 -596 -596 196 296 2012 2013 596 296 119 -396 296 2014 -596 196 296 496 196 2015 49 496 496 596 196 1. Use the above table of returns to answer the following questions: a. Calculate the returns of an equally weighted portfolio of A, B and C b. Calculate the betas of A, B, C and the equally weighted portfolio using the variances and covariances of the returns c. Calculate the betas of A, B, C and the equally weighted portfolio using the variances and covariances of the excess returns d. Do you get the same numbers under a) and b)? Explain. 2. Use the below tables to answer the following question a. Calculate the debt to capital ratio (book) and the operating margin for both years b. If you invested $5,000,010 in 2018, how much of the company would you own in 2018 (in percent and the number of shares)? c. How much is your investment worth in 2019? d. How much is your new ownership share in percent and the number of shares in 2019 (assuming you did not buy/sell/receive any additional shares)? 2. Use the below tables to answer the following quesRon a. Calculate the debt to capital raRo (book) and the operaRng margin for both years b. If you invested $5,000,010 in 2018, how much of the company would you own in 2018 (in percent and the number of shares)? c. How much is your investment worth in 2019? d. How much is your new ownership share in percent and the number of shares in 2019 (assuming you did not buy/sell/receive any addiRonal shares)? Year A Market Index Treasury 2010 196 1196 196 296 196 2011 296 5% 596 496 296 1196 -596 -596 196 296 2012 2013 596 296 119 -396 296 2014 -596 196 296 496 196 2015 49 496 496 596 196 1. Use the above table of returns to answer the following questions: a. Calculate the returns of an equally weighted portfolio of A, B and C b. Calculate the betas of A, B, C and the equally weighted portfolio using the variances and covariances of the returns c. Calculate the betas of A, B, C and the equally weighted portfolio using the variances and covariances of the excess returns d. Do you get the same numbers under a) and b)? Explain. 2. Use the below tables to answer the following question a. Calculate the debt to capital ratio (book) and the operating margin for both years b. If you invested $5,000,010 in 2018, how much of the company would you own in 2018 (in percent and the number of shares)? c. How much is your investment worth in 2019? d. How much is your new ownership share in percent and the number of shares in 2019 (assuming you did not buy/sell/receive any additional shares)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts