Question: Please show the calculations for the answer provided in the excel sheet (i.e how are formulas sued and how are the steps followed). Problem 2

Please show the calculations for the answer provided in the excel sheet (i.e how are formulas sued and how are the steps followed).

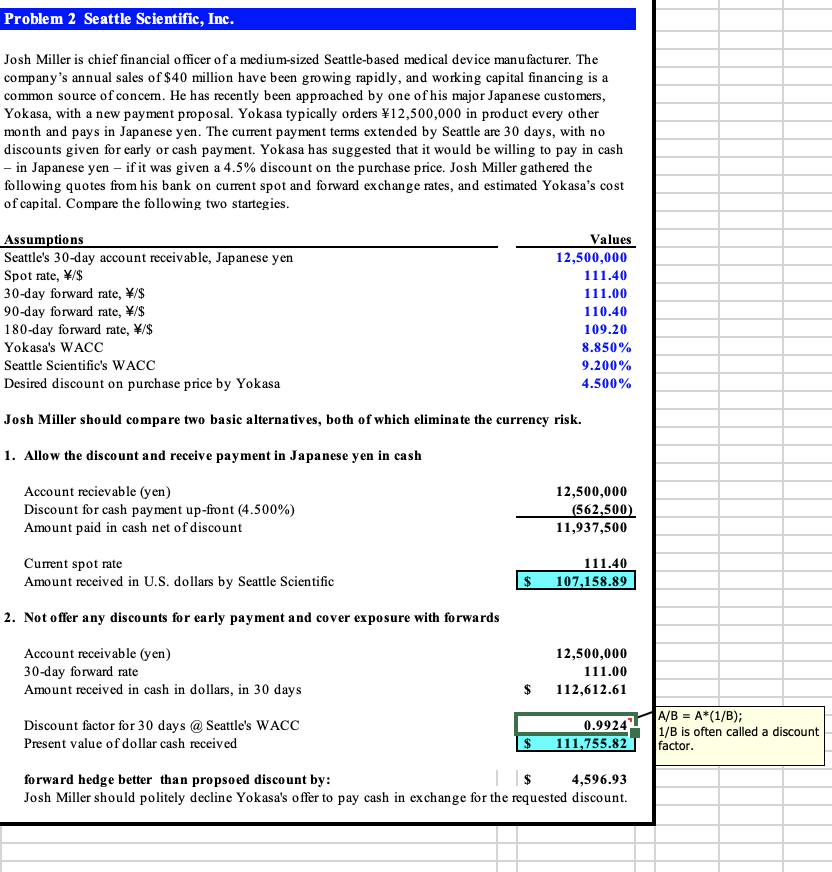

Problem 2 Seattle Scientific, Inc. Josh Miller is chief financial officer of a medium-sized Seattle-based medical device manufacturer. The company's annual sales of $40 million have been growing rapidly, and working capital financing is a common source of concern. He has recently been approached by one of his major Japanese customers, Yokasa, with a new payment proposal. Yokasa typically orders \12,500,000 in product every other month and pays in Japanese yen. The current payment terms extended by Seattle are 30 days, with no discounts given for early or cash payment. Yokasa has suggested that it would be willing to pay in cash - in Japanese yen - if it was given a 4.5% discount on the purchase price. Josh Miller gathered the following quotes from his bank on current spot and forward exchange rates, and estimated Yokasa's cost of capital. Compare the following two startegies. Assumptions Seattle's 30-day account receivable, Japanese yen Spot rate, W/$ 30-day forward rate, /$ 90-day forward rate, /$ 180-day forward rate, /$ Yokasa's WACC Seattle Scientific's WACC Desired discount on purchase price by Yokasa Values 12,500,000 111.40 111.00 110.40 109.20 8.850% 9.200% 4.500% Josh Miller should compare two basic alternatives, both of which eliminate the currency risk. 1. Allow the discount and receive payment in Japanese yen in cash Account recievable (yen) Discount for cash payment up-front (4.500%) Amount paid in cash net of discount 12,500,000 (562,500) 11,937,500 Current spot rate Amount received in U.S. dollars by Seattle Scientific 111.40 107,158.89 2. Not offer any discounts for early payment and cover exposure with forwards Account receivable (yen) 30-day forward rate Amount received in cash in dollars, in 30 days 12,500,000 111.00 112,612.61 $ Discount factor for 30 days @ Seattle's WACC Present value of dollar cash received 0.9924 111,755.82 A/B = A*(1/B); 1/B is often called a discount factor. $ forward hedge better than propsoed discount by: | $ 4,596.93 Josh Miller should politely decline Yokasa's offer to pay cash in exchange for the requested discount

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts