Question: please show the calculations (without excel) A security analyst has forecasted returns on the market portfolio and shares of RIM under three different economic conditions

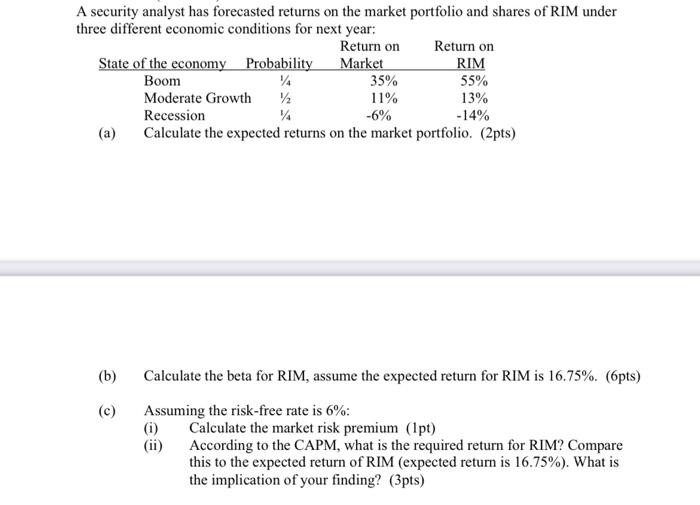

A security analyst has forecasted returns on the market portfolio and shares of RIM under three different economic conditions for next year: Return on Return on State of the economy Probability Market RIM Boom VA 35% 55% Moderate Growth 12 11% 13% Recession VA -6% -14% (a) Calculate the expected returns on the market portfolio. (2pts) (b) (c) Calculate the beta for RIM, assume the expected return for RIM is 16.75%. (6pts) Assuming the risk-free rate is 6%: (i) Calculate the market risk premium (1 pt) (ii) According to the CAPM, what is the required return for RIM? Compare this to the expected return of RIM (expected return is 16.75%). What is the implication of your finding? (3pts)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts