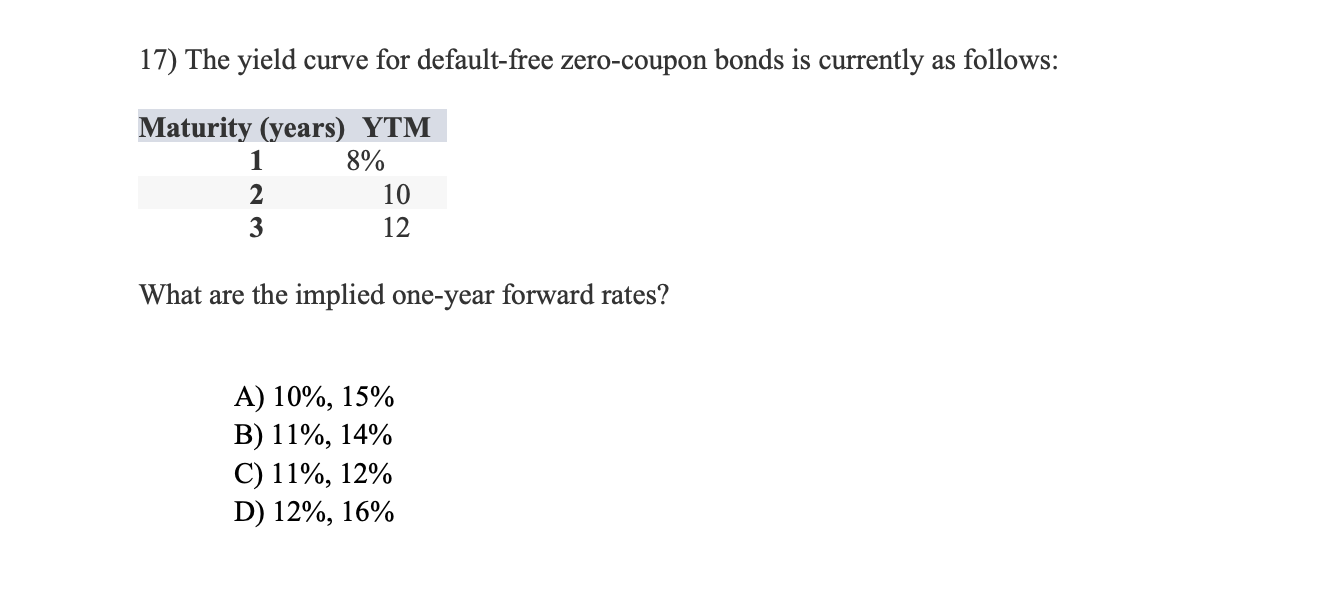

Question: Please show the math 17) The yield curve for default-free zero-coupon bonds is currently as follows: What are the implied one-year forward rates? A) 10%,15%

Please show the math

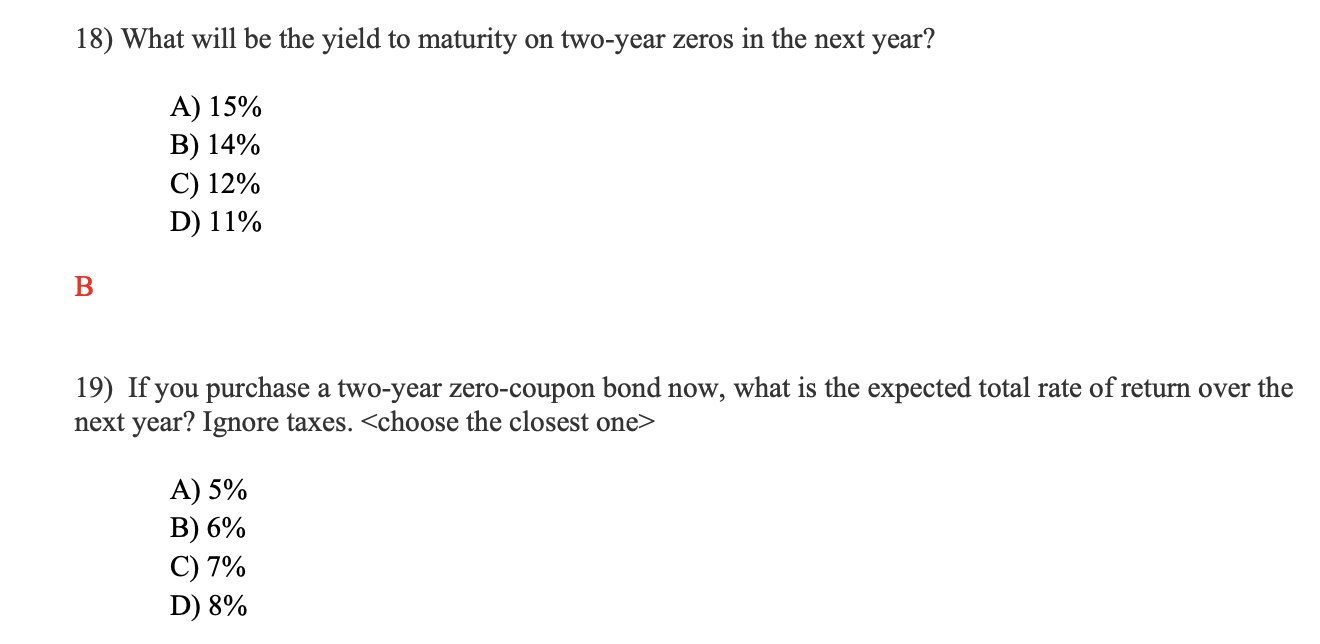

17) The yield curve for default-free zero-coupon bonds is currently as follows: What are the implied one-year forward rates? A) 10%,15% B) 11%,14% C) 11%,12% D) 12%,16% 18) What will be the yield to maturity on two-year zeros in the next year? A) 15% B) 14% C) 12% D) 11% B 19) If you purchase a two-year zero-coupon bond now, what is the expected total rate of return over the next year? Ignore taxes. A) 5% B) 6% C) 7% D) 8%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts