Question: Please show the steps for how this is solved. Additionally, why could the bank purchase the garage before the private lender? Didn't the lender have

Please show the steps for how this is solved.

Additionally, why could the bank purchase the garage before the private lender? Didn't the lender have a purchase money mortgage on the garage?

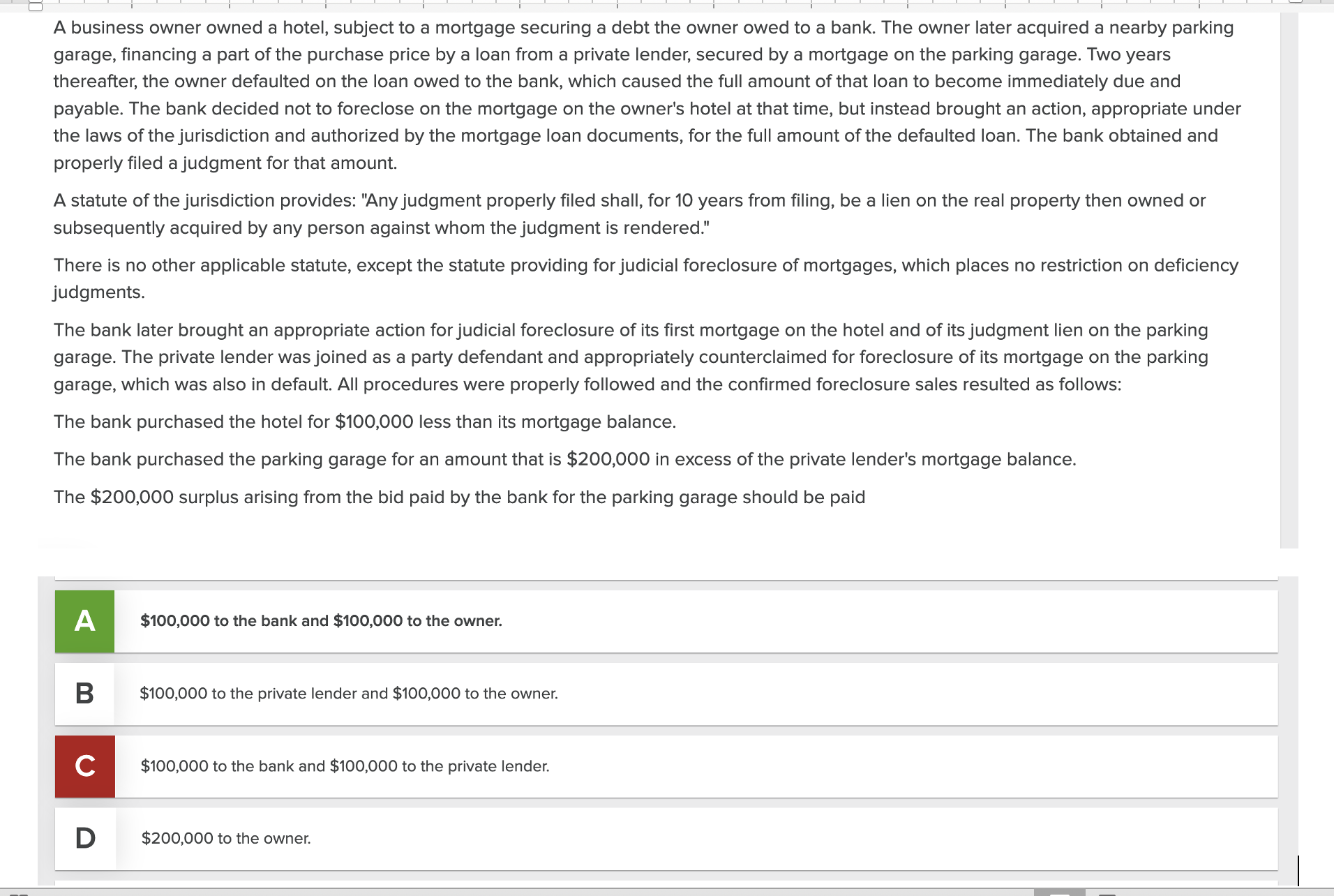

A business owner owned a hotel, subject to a mortgage securing a debt the owner owed to a bank. The owner later acquired a nearby parking garage, financing a part of the purchase price by a loan from a private lender, secured by a mortgage on the parking garage. Two years thereafter, the owner defaulted on the loan owed to the bank, which caused the full amount of that loan to become immediately due and payable. The bank decided not to foreclose on the mortgage on the owner's hotel at that time, but instead brought an action, appropriate under the laws of the jurisdiction and authorized by the mortgage loan documents, for the full amount of the defaulted loan. The bank obtained and properly filed a judgment for that amount. A statute of the jurisdiction provides: "Any judgment properly filed shall, for 10 years from filing, be a lien on the real property then owned or subsequently acquired by any person against whom the judgment is rendered." There is no other applicable statute, except the statute providing for judicial foreclosure of mortgages, which places no restriction on deficiency judgments. The bank later brought an appropriate action for judicial foreclosure of its first mortgage on the hotel and of its judgment lien on the parking garage. The private lender was joined as a party defendant and appropriately counterclaimed for foreclosure of its mortgage on the parking garage, which was also in default. All procedures were properly followed and the confirmed foreclosure sales resulted as follows: The bank purchased the hotel for $100,000 less than its mortgage balance. The bank purchased the parking garage for an amount that is $200,000 in excess of the private lender's mortgage balance. The $200,000 surplus arising from the bid paid by the bank for the parking garage should be paid n $100,000 to the bank and $100,000 to the owner. B $100,000 to the private lender and $100,000 to the owner. $100,000 to the bank and $100,000 to the private lender. D $200,000 to the owner

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts