Question: Please show the steps to finding the answer using a *Financial Calculator*! Thank you. 1) The U.S. Treasury issued a 7-year maturity, $1000 par value

Please show the steps to finding the answer using a *Financial Calculator*! Thank you.

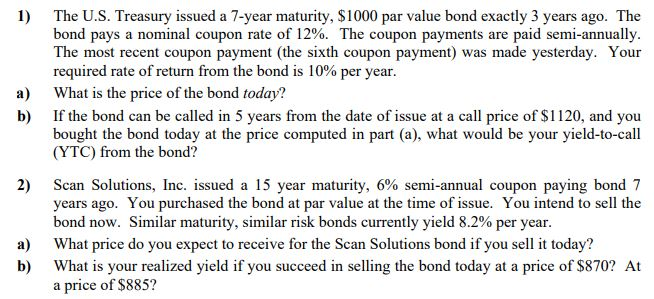

1) The U.S. Treasury issued a 7-year maturity, $1000 par value bond exactly 3 years ago. The bond pays a nominal coupon rate of 12%. The coupon payments are paid semi-annually The most recent coupon payment (the sixth coupon payment) was made yesterday. Your required rate of return from the bond is 10% per year What is the price of the bond today? If the bond can be called in 5 years from the date of issue at a call price of $1120, and you bought the bond today at the price computed in part (a), what would be your yield-to-call (YTC) from the bond? a) b) 2) Scan Solutions, Inc. issued a 15 year maturity, 6% semi-annual coupon paying bond 7 years ago. You purchased the bond at par value at the time of issue. You intend to sell the bond now. Similar maturity, similar risk bonds currently yield 8.2% per year What price do you expect to receive for the Scan Solutions bond if you sell it today? What is your realized yield if you succeed in selling the bond today at a price of $870? At a price of $885? a) b)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts