Question: Please show the steps to getting the answer. I truly want to know how to do this. 1. A company is considering buying one of

Please show the steps to getting the answer. I truly want to know how to do this.

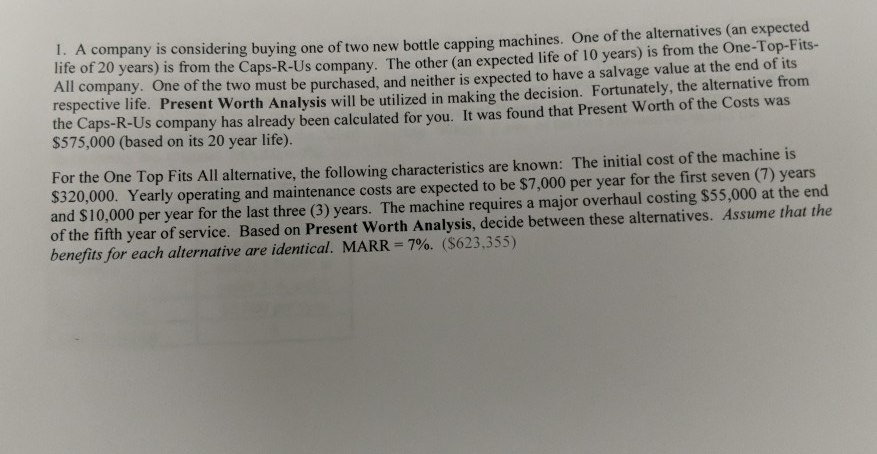

1. A company is considering buying one of two new bottle capping machines. One of the alternatives (an expected ife of 20 years) is from the Caps-R-Us company. The other (an expected life of 10 years) is from the One-Top-Fits- All company. One of the two must be purchased, and neither is expected to have a salvage value at the end of its respective life. Present Worth Analysis will be utilized in making the decision. Fortunately, the alternative from the Caps-R-Us company has already been calculated for you. It was found that Present Worth of the Costs was $575,000 (based on its 20 year life). For the One Top Fits All alternative, the following characteristics are known: The initial cost of the machine is $320,000. Yearly operating and maintenance costs are and $10,000 per year for the last three (3) years. The machine requires a major overhaul costing $55,000 at the end of the fifth year of service. Based on Present Worth Analysis, decide between these alternatives. Assume that the benefits for each alternative are expected to be $7,000 per year for the first seven (7) years 7% . ( $ 623 ,355) identical. MARR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts